By Cary Wise

I sometimes run into risk quantification fans who are sold on the process but just don’t know how to get started. But conceptually, with the FAIR model, quantitative risk analysis has a simple and logical flow, and the RiskLens platform automates the complexity and scale that can make enterprise-level risk quantification difficult and time-consuming.

Here I broke the process down to four simple steps to analyze a question that any organization will face: invest in a control or not (in this case, encryption for a PII database). Try this and you’ll be on your way to regularly making informed, risk-based decisions that effectively manage the limited resources of your organization.

1. Identify current risk exposure

To begin evaluating the control investment, you must first understand the current risk exposure related to the scenario without the control in place. For example, if the purpose of the analysis is to assess the risk reduction associated with implementing encryption on a database containing customer PII, the first step would be to assess how much risk is associated with a breach of said database in its current state. Analyzing the current state risk exposure involves a four-step process:

- Scope the Scenario

- Gather the Data

- Run the Analysis, Q/A the Results, Refine the Estimates

- Report the Results

For more detail, see The Risk Analysis Process at RiskLens.

2. Map the control being considered to the FAIR Model

After you have an understanding of the current state risk exposure, you can assess how the control you are considering would impact the analysis. It is common for people to associate controls with vulnerability and resistance strength, and assume their only benefit is preventing the loss event from occurring, however, using the FAIR model, there are four main control categories:

- Avoidance

- Deterrence

- Resistance

- Responsive

Each of the above categories maps to a different area of the model and impacts the analysis in a different way.

For more information, see How to Model Controls in a FAIR Analysis.

In the example above, encryption would be modeled as a Responsive control as it changes the potential losses you would experience from the event.

3. Perform a future state analysis, evaluating the effectiveness of the control

Once you have mapped the control to the FAIR model, the next step is to understand how and to what extent encryption would specifically impact loss exposure. Given that encryption renders the information virtually useless, it would impact the Secondary Loss Event Frequency and reduce the likelihood of additional costs such as notifying customers, fines and judgments, credit monitoring, and reputation damage.

After determining how the control would impact the analysis, you can then version the current state analysis and assess the future state loss exposure with the control in place.

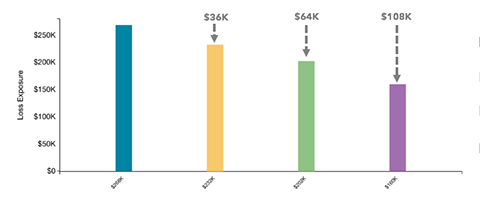

4. Compare the current state vs. future state to perform a cost-benefit analysis

Having completed both analyses, you will be able to see both the current state loss exposure as well as the future state loss exposure with the control improvement taken into consideration. This allows you to determine the reduction in annualized loss exposure, which can then be used to create a cost-benefit analysis for the control investment.

(Here’s a generic look at the output from a RiskLens analysis comparing the current state on the left and various controls reducing loss exposure)