Autonomous CRQ With

Know, Understand,

Communicate Risks

Strategic Investment

Planning

Regulatory and

Compliance Readiness

Trusted By Industry Leaders

SAFE CRQ Use Cases

Continuous Assessment

and Monitoring

Strategic Investment

Planning

Risk-Based Operational

Prioritization

Dashboards and

Reporting

Emerging and AI Risk

Management

Continuous Assessment and Monitoring

Get continuous, real-time, data-driven cyber risk visibility across your enterprise.

- Continuously ingests signals from 100+ tools in your security ecosystem.

- Derive risk from your compliance and regulatory assessments.

- Automatically get updated insights from external threat intel.

Strategic Investment Planning

Align security investments to ROI with clear, measurable financial outcomes.

- Directs investments where they drive the greatest risk reduction.

- Enables project prioritization, budget justification, and stack rationalization.

- Compares initiatives to identify those delivering the highest ROI.

Risk-Based Operational Prioritization

Automate control effectiveness assessments to quantify impact on risk reduction.

- Translate control effectiveness directly into financial impact with FAIR-CAM.

- Continuously updated findings for prioritized risk burndown decisions.

- Links control performance to measurable business risk outcomes.

Dashboards and Reporting

Translate cyber risk from technical language to business and financial terms that matter.

- Quantifies cyber risk in financial terms for clear communication.

- Offers customizable dashboards tailored to stakeholder priorities.

- Get defensible, regulator-ready reports for SEC, NYDFS, and more.

Emerging and AI Risk Management

Stay ahead of evolving risks – from generative AI to new threat vectors.

- Identifies and quantifies emerging risk scenarios, including GenAI risks.

- Guides leaders to allocate resources to high-impact risk areas.

- Strengthens organizational resilience to recover from emerging risks.

Continuous Assessment and Monitoring

Get continuous, real-time, data-driven cyber risk visibility across your enterprise.

- Continuously ingests signals from 100+ tools in your security ecosystem.

- Derive risk from your compliance and regulatory assessments.

- Automatically get updated insights from external threat intel.

Strategic Investment Planning

Align security investments to ROI with clear, measurable financial outcomes.

- Directs investments where they drive the greatest risk reduction.

- Enables project prioritization, budget justification, and stack rationalization.

- Compares initiatives to identify those delivering the highest ROI.

Risk-Based Operational Prioritization

Automate control effectiveness assessments to quantify impact on risk reduction.

- Translate control effectiveness directly into financial impact with FAIR-CAM.

- Continuously updated findings for prioritized risk burndown decisions.

- Links control performance to measurable business risk outcomes.

Dashboards and Reporting

Translate cyber risk from technical language to business and financial terms that matter.

- Quantifies cyber risk in financial terms for clear communication.

- Offers customizable dashboards tailored to stakeholder priorities.

- Get defensible, regulator-ready reports for SEC, NYDFS, and more.

Emerging and AI Risk Management

Stay ahead of evolving risks – from generative AI to new threat vectors.

- Identifies and quantifies emerging risk scenarios, including GenAI risks.

- Guides leaders to allocate resources to high-impact risk areas.

- Strengthens organizational resilience to recover from emerging risks.

Purpose-Built on Globally Trusted Open Standards

"SAFE offers a comprehensive cyber risk management platform that is built on the full set of FAIR standards."

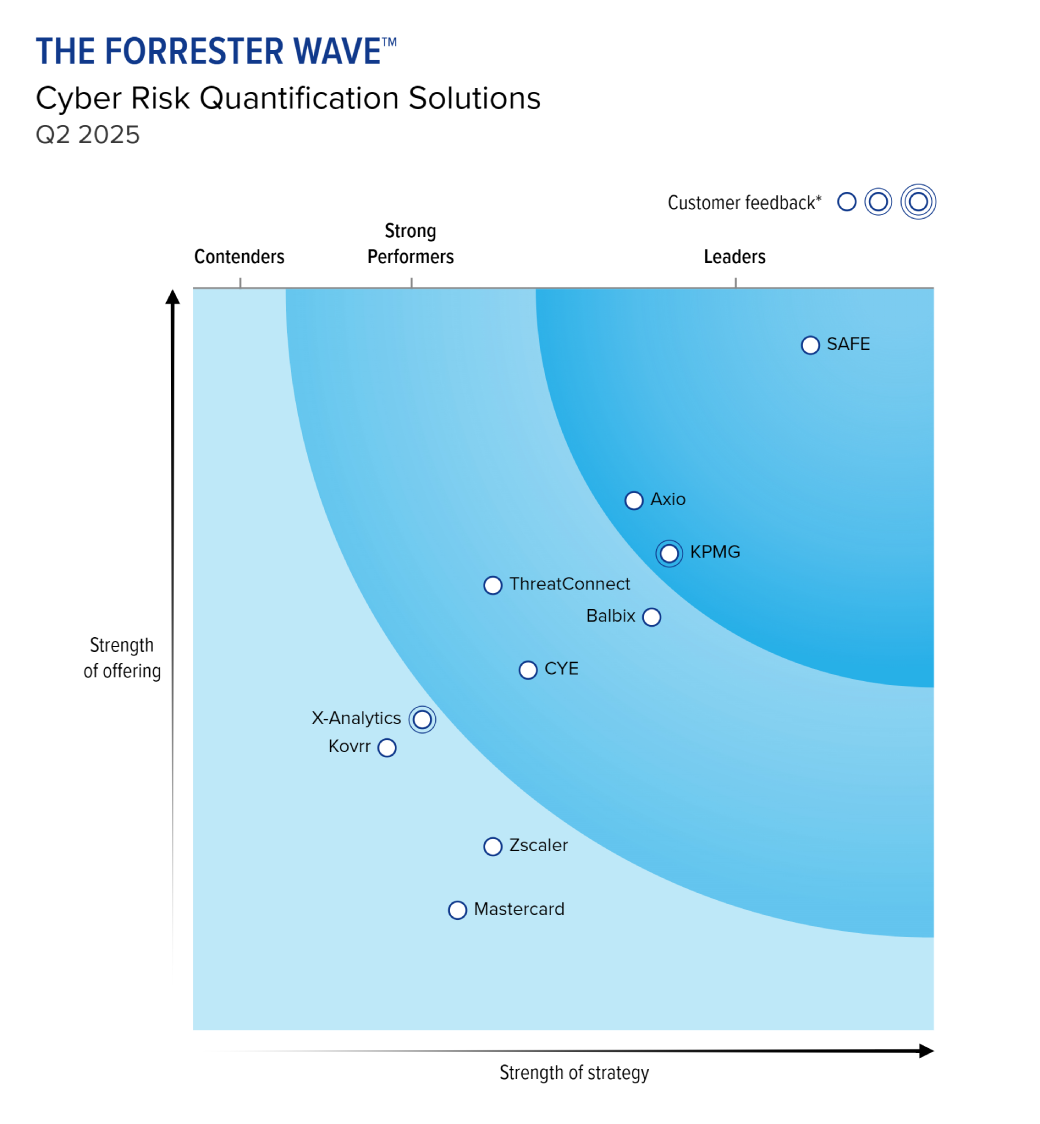

The Forrester Wave™: Cyber Risk Quantification Solutions, Q2 2025Get Financial Impact of Cyber Risk with FAIR-MAM

Loss Magnitude and Annualized Loss Exposure numbers based on accurate, transparent, and defensible data powered by FAIR-MAM. Stay audit ready and SEC compliant with real-time materiality impact analysis.

LEARN MORE →See Control Efficacy with Automated FAIR-CAM

Continuous control monitoring based on contextual information across coverage, capability, and reliability. Automate your control assessments with real-time data and make ROI-driven security investment decisions.

LEARN MORE →FAQ

How does SAFE perform Cyber Risk Quantification?

SAFE ingests telemetry from 100+ security, IT, and business systems already present in your environment — from endpoint and identity tools to vulnerability, GRC, and cloud data — to model financial risk using the FAIR (Factor Analysis of Information Risk) framework. This creates defensible, standardized, and continuously updated risk estimates tailored to your business context.

What data sources does SAFE CRQ use?

SAFE’s autonomous CRQ models draw on a mix of internal and external data:

- Internal control and exposure data (from tools like CMDB, IAM, vulnerability scanners, etc.). Check out our Integrations Marketplace to learn more.

- Business impact data (asset criticality, revenue linkage, regulatory exposure).

- External threat intelligence and industry benchmarks

This combination ensures risk quantification reflects real-world likelihood and impact.

Who benefits most from implementing SAFE CRQ?

- CISOs & Risk Teams — gain continuous visibility on existing and emerging risks across their enterprise.

- CFOs & Boards — get insights in the same financial metrics as other business risks enabling clearer understanding of cyber risks and more effective decision-making

- Security Operations — can focus remediation where it will have the greatest financial impact.

In short, CRQ bridges the gap between security and business strategy.

How often should SAFE CRQ be updated?

Traditional risk assessments are static snapshots. SAFE’s CRQ is continuous — dynamically updating as your threat landscape, controls, or business context changes. This ensures risk values stay current, measurable, and defensible for regulatory reviews, board reporting, and insurance purposes.

How does CRQ help optimize budget and investment decisions?

SAFE’s Autonomous CRQ gives cybersecurity leaders a financial lens to compare risks and justify spend. By quantifying loss exposure versus mitigation cost, organizations can prioritize controls and investments that deliver the highest return on risk reduction — ensuring every dollar spent reduces measurable business risk.