Unlock Up to 30% Cyber Insurance Savings with SAFE & Mosaic

Save time & money with a data-driven cyber insurance discount

SAFE customers can now unlock cyber insurance premium and deductible discounts of up to 30%—without additional paperwork or underwriting interviews. Through our partnership with Mosaic Insurance, organizations can secure better policy terms simply by leveraging their existing SAFE cyber risk assessment.

The Challenge: Inefficiencies in Cyber Insurance

Cumbersome & Time-Consuming Process

Organizations spend 50-100+ hours navigating cyber insurance renewals, often without clear guidance on optimizing terms or reducing costs. Security leaders are tasked with gathering risk data, while CFOs and risk managers struggle with limited transparency in pricing as the true business ‘owners’ of cyber insurance.

Lack of Actionable Risk Insights

Traditional underwriting relies on outside-in telemetry and outdated, survey-based security assessments that fail to quantify and provide meaningful insights into an organization’s true cyber risk.

How Do You Compare to Your Peers?

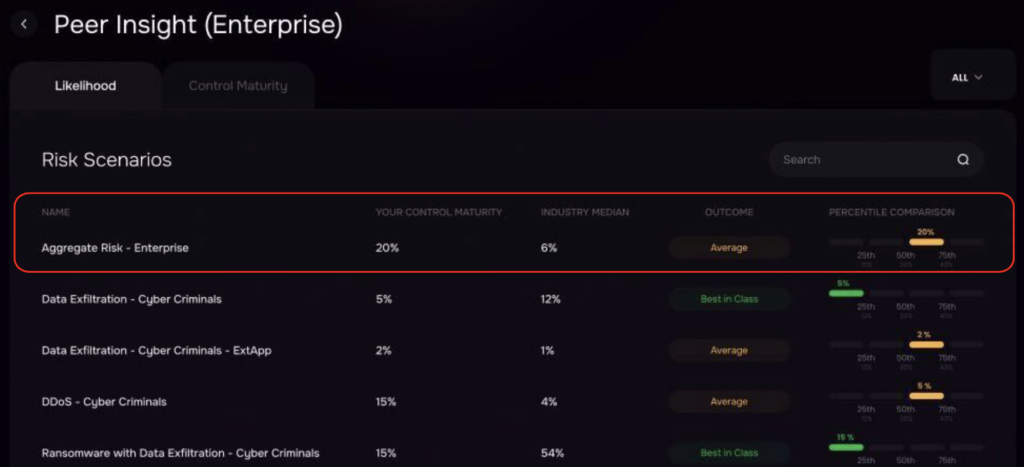

One of the biggest questions from CISOs and insurance partners is: ‘How does our security program compare?’ SAFE’s ‘Peer Insights’ now provides real-time breach likelihood benchmarking, allowing organizations to compare their risk posture against anonymized industry data.

SAFE & Mosaic’s Exclusive Insurance Incentive

Mosaic Insurance has integrated SAFE into its cyber underwriting process, allowing organizations to qualify for guaranteed premium discounts based on their risk posture:

– 5% Discount Guaranteed – All organizations who subscribe to SAFE Essentials qualify.

– 15% Discount – Organizations with an ‘Average’ Enterprise Breach Likelihood compared to their Peers.

– 30% Discount – Organizations with a ‘Best-in-Class’ Enterprise Breach Likelihood compared to their Peers..

Why This Matters for SAFE Customers

1. Significant Cost Savings

– Save up to 30% on cyber insurance—potentially covering the cost of SAFE Essentials.

2. Eliminate Tedious Renewal Processes

– Reduce renewal time by 50-100+ hours with automated SAFE-generated reports.

3. Clear, Actionable Cyber Risk Roadmap

– Identify which controls to improve for better policy terms and savings.

4. Predictable, Risk-Based Pricing

– The SAFE and Mosaic partnership ensure policies are priced to the actual risk of an organization, not market-based pricing, reducing year-over-year volatility in premiums.

Real-World Success: Intuitive Cloud’s Experience

Learn how Intuitive Cloud used SAFE to:

– Save 100+ hours during renewal.

– Unlock 20% in premium savings with Mosaic Insurance.

– Improve security posture and secure better coverage.

Intuitive Cloud Customer Spotlight

How to Activate Your Discount

1. Subscribe to SAFE Essentials

– Integrate up to five Cloud, SaaS, or Security Solutions into SAFE.

2. Generate Your Cyber Insurance Report

– SAFE automatically produces a transparent risk assessment.

3. Share with Your Broker & Mosaic Insurance

– Submit the report to your insurance broker and Mosaic Insurance at renewal.

Start Saving Today

This incentive is live now and available to all SAFE enterprise customers worldwide.

📩 Want to explore your potential savings? Contact your SAFE Customer Success lead or email [email protected] to get started.