How SAFE Powers Best-in-Class Cyber Risk Governance

AI-powered automation across CRQ, TPRM and CTEM enables boards and executives to exceed world standards.

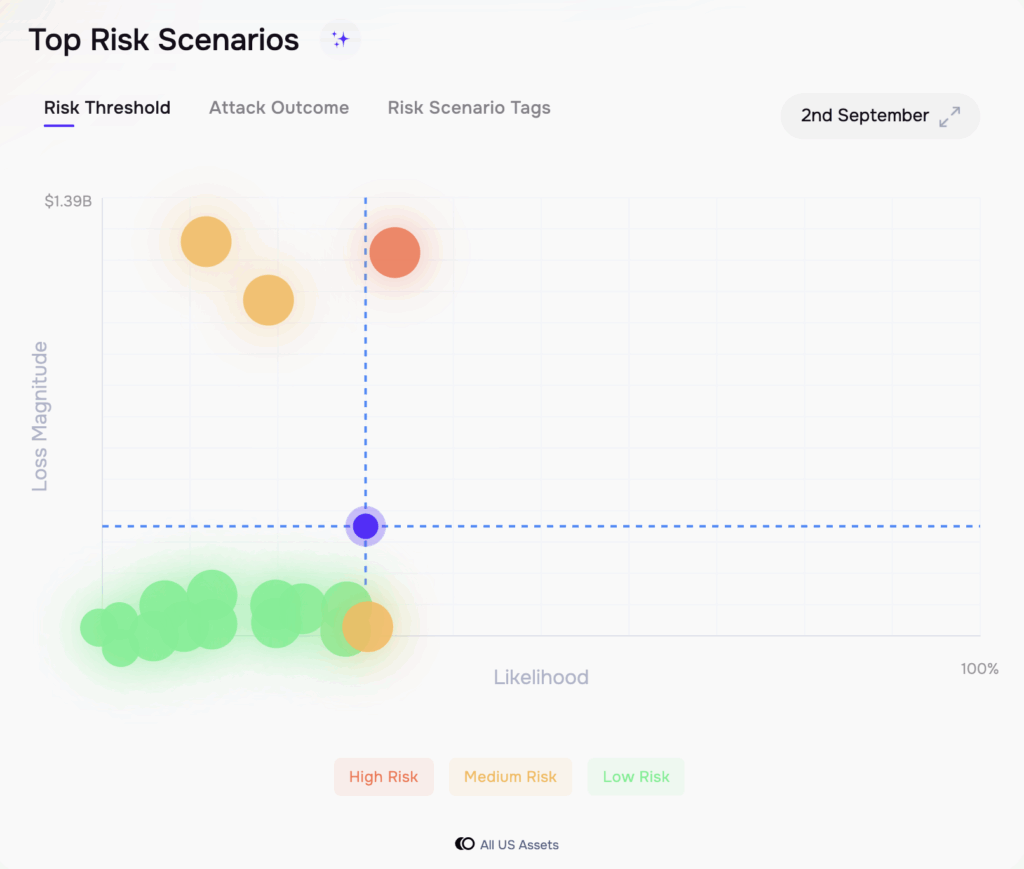

Image: SAFE One platform: quantitative heat map

Cyber risk governance is no longer optional. Regulators, investors, and customers expect boards to oversee cyber risk with the same rigor as financial, credit, or operational risks. The challenge? Most organizations are still stuck with fragmented metrics, technical jargon, and disconnected tools that fail to inform strategic decision-making.

SAFE was built to solve this problem. By combining the FAIR™ model with AI-powered automation across cyber risk quantification (CRQ), third-party risk management (TPRM), and continuous threat exposure management (CTEM), SAFE enables boards and executives to meet — and exceed — the defining attributes of world-class cyber risk governance.

1. Elevating Cyber to a Strategic Business Risk

SAFE translates cyber risk into financial terms that boards understand. Instead of drowning in patch counts and CVSS scores, directors see the expected financial impact of cyber scenarios on critical business objectives. This allows boards to compare cyber risk to other enterprise risks, set a clear risk appetite, and hold management accountable for performance against it.

2. Enabling Clear Governance Structures

Effective governance requires alignment across the board, management, and business units. SAFE provides a single source of truth for cyber risk, ensuring the CISO, CFO, CRO, and business leaders are working from the same quantified risk picture. This empowers cross-functional cyber risk councils, supports board oversight, and embeds cyber accountability into the enterprise governance framework.

3. Driving Business-Aligned Risk Reporting

SAFE delivers board-ready dashboards that answer the most important governance questions:

- What is our current cyber risk exposure relative to risk appetite?

- What are the top risk scenarios and their potential financial loss?

- How effective are our controls and investments at reducing risk?

- Where are the exposures across business units and third parties?

By automating FAIR-based risk quantification and aligning reporting to financial impact, SAFE makes it easy for directors to make informed tradeoffs and ensure resources are allocated where they matter most.

4. Powering Continuous Assessment and Prioritization

World-class governance requires continuous monitoring, not point-in-time audits. SAFE integrates exposure data across vulnerabilities, third-party ecosystems, cloud, infrastructure, and applications — then autonomously prioritizes remediation based on financial risk. This ensures the board can be confident that the organization isn’t chasing severity scores but addressing the risks that truly threaten enterprise value.

5. Meeting Regulatory Expectations with Confidence

Whether it’s the SEC’s cyber disclosure rules, Europe’s DORA, or NIS2, SAFE helps organizations map risk to regulatory requirements, assess materiality, and generate defensible disclosures. By documenting board engagement and quantifying risk in financial terms, SAFE provides a governance framework that regulators recognize as rigorous and accountable.

6. Strengthening Crisis Management and Resilience

SAFE enhances crisis preparedness by quantifying the financial impact of potential incident scenarios — from ransomware to supply chain breaches. These quantified scenarios inform tabletop exercises with the board, executives, and advisors, ensuring recovery and continuity plans are measured not just by technical metrics, but by their ability to protect enterprise value, reputation, and trust.

The Bottom Line: SAFE as the Governance Engine

Directors are under pressure to demonstrate cyber risk governance at a world-class level. SAFE is the only platform that unifies quantification, automation, and continuous monitoring to make this possible.

By empowering boards and executives with financial insight, regulatory confidence, and resilience-focused oversight, SAFE helps organizations not just reduce cyber risk — but govern it as a true strategic business risk, building long-term enterprise value and digital trust.

Get Started with SAFE – Schedule a Demo

The only Agentic AI-driven Continuous Cyber Risk Management platform. Integrate and automate Third Party Risk Management (TPRM) and Cyber Risk Quantification.