Dashboards show risk posture, material risks, regulatory compliance, program investment

In today’s high-stakes environment, boards of directors are under growing pressure—from regulators, shareholders, and stakeholders—to govern cyber risk not as a technical silo, but as a material business risk.

Cybersecurity oversight is no longer optional. But it’s also no longer enough for CISOs to report on patching progress or compliance checklists. Boards want to understand how cyber risk affects the business, how it’s being managed, and how prepared the organization is for the worst-case scenario.

The challenge? Translating technical complexity into business-relevant, decision-grade insights—in a repeatable, defensible, and trusted way.

That’s where the 6 Pillars of Cyber Risk Reporting come in.

- Author Nick Sanna is President of SAFE. Read more from Nick: How SAFE Powers Best-in-Class Cyber Risk Governance

Pillar 1: Cyber Risk Posture Overview

What the Board Needs

A concise, executive-level view of the organization’s current cybersecurity risk posture—framed in business terms.

This includes:

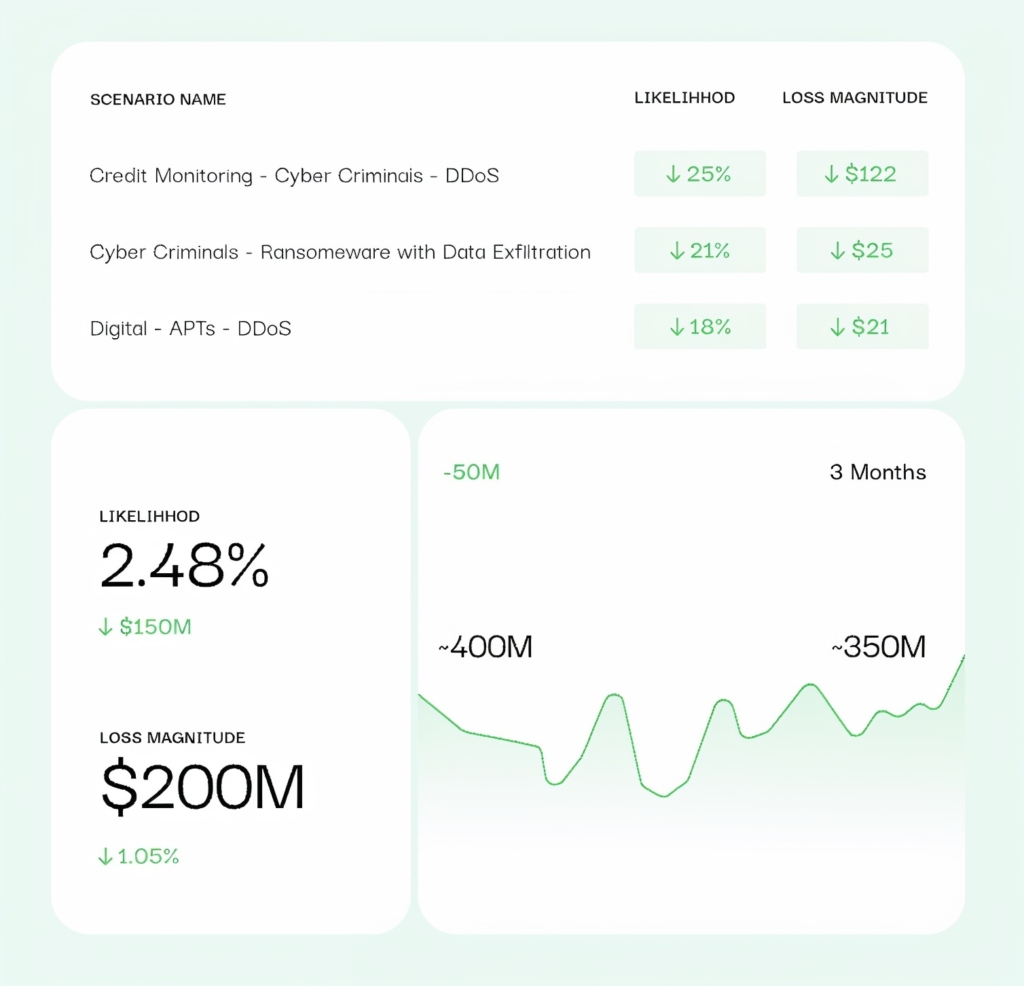

- Top risk scenarios (internal and third-party)

- Likelihood and financial impact

- Performance against board-approved cyber risk appetite

- Trends over time (improvement or deterioration)

How SAFE Helps

SAFE delivers a real-time risk dashboard, powered by the FAIR™ model, that quantifies cyber risk across business units. The board can instantly see where risk is concentrated, whether it’s within tolerance, and how posture is evolving over time.

✅ Business-aligned.

✅ Quantified in dollars.

✅ Mapped to risk appetite.

Pillar 2: Material Risk Scenarios

What the Board Needs

A focused briefing on a few high-impact cyber scenarios—those that could disrupt operations, revenue, or reputation.

Each scenario should include:

- Estimated likelihood and financial exposure

- Control readiness and gaps

- Remediation timelines

How SAFE Helps

SAFE automatically models your most pressing scenarios—ransomware, vendor compromise, data breaches, cloud outages—simulates financial exposure, and recommends the most effective treatment options.

📈 SAFE turns risk scenarios into boardroom-ready stories of exposure, readiness, and progress.

Pillar 3: Incident Reporting & Response Readiness

What the Board Needs

Clear updates on significant cyber incidents—and how the organization responded.

Boards should be informed of:

- Nature and scope of the incident

- Response actions taken

- Regulatory disclosures

- Recovery timelines

- Lessons learned

How SAFE Helps

SAFE provides the necessary context to assess the impact of cyber incidents, including the many ways in which losses materialize, as well as the recommended actions to mitigate such incidents in the future.

🛡️ Crisis moments become opportunities to demonstrate competence and resilience.

Pillar 4: Regulatory and Compliance Status

What the Board Needs

A high-level view of compliance with applicable cyber regulations (e.g., SEC, DORA, NIS2, HIPAA, NYDFS).

Boards need to understand:

- Current status

- Known gaps

- Plans and timelines to close deficiencies

How SAFE Helps

SAFE maps risk posture to global regulatory frameworks, surfaces compliance gaps, and their significance as it relates to risk—so CISOs can confidently brief boards on the state of compliance, without drowning them in detail.

🔎 Boards can evaluate the significance of possible compliance gaps and provide guidance accordingly.

Pillar 5: Risk Metrics and KPIs

What the Board Needs

A digestible, high-level dashboard of risk and performance metrics that show where the organization stands—and where it’s headed.

Common board KPIs include:

- Risk quantification by business unit

- Third-party risk exposure

- Incident trends

- Control maturity

- Security awareness engagement

How SAFE Helps

SAFE curates a set of board-ready cyber risk indicators aligned to business outcomes, for both internal and third party risks. These dashboards are customizable, defensible, and easily exportable for board packets and audit committees.

🎯 From technical noise to strategic signal.

Pillar 6: Program Investment & Resourcing

What the Board Needs

Visibility into whether cyber resources—people, technology, budget—are aligned with organizational risk appetite and are delivering measurable ROI.

Key questions include:

- Are we investing enough?

- Are we investing in the right areas?

- What is our risk reduction per dollar spent?

How SAFE Helps

SAFE benchmarks your cyber risk against industry peers, quantifies ROI on mitigation efforts, and surfaces underperforming investments. It gives CISOs the data to make a strong case for new funding—or show responsible stewardship of existing budgets.

🧮 Justify investments based on risk reduction, not fear or intuition.

From Ad Hoc to Accountable: SAFE Makes Board Reporting Seamless

When CISOs rely on spreadsheets, siloed tools, or manually assembled decks, reporting becomes reactive and time-consuming. Worse, it puts credibility and clarity at risk.

With SAFE, CISOs gain:

- A single source of truth for cyber risk quantification

- Automated board-ready dashboards aligned to FAIR and global cybersecurity standards

- Tools to translate technical findings into economic and strategic insights

- Confidence to brief the board, the audit committee, regulators, and the CEO—on demand

Cyber risk reporting isn’t just a compliance requirement. It’s a strategic advantage.

With SAFE, CISOs can finally own the board conversation—and elevate cybersecurity to its rightful place as a core pillar of enterprise risk.

Want to see how SAFE transforms cyber risk reporting for board oversight?

Schedule a demo to experience how AI-powered automation, financial quantification, and real-time dashboards are changing the game for CISOs worldwide.