Meet OSFI’s Third-Party Risk Mandate with SAFE’s TPRM Solution

In-depth risk analysis, criticality warning, real time monitoring – just what the regulators ordered

The news this year that Canada’s largest banks – Royal Bank of Canada, Toronto-Dominion and Bank of Montreal – were all disrupted by the faulty Windows update distributed by CrowdStrike made the point: third party cyber risk management (TPRM) has jumped to the top of the agenda of every CISO – and regulators as well.

Canada’s banking supervisor, the Office of Superintendent of Financial Institutions (OSFI) mandated stringent TPRM requirements for federally regulated financial institutions (FRFIs) in its Guideline B-10, saying it was determined to head off risks “from third-party arrangements that can threaten the FRFI’s operational and financial resilience”.

We designed SAFE’s TPRM solution as a robust platform to meet OSFI’s demands while enhancing overall risk management strategies. Traditional third party cyber risk management relies on lengthy questionnaires that produce incomplete and rapidly outdated assessments of an organization’s controls. The SAFE TPRM platform takes an AI-powered, risk-based approach, focusing on the most critical controls, derived from extensive research of current and past third-party cyber attacks.

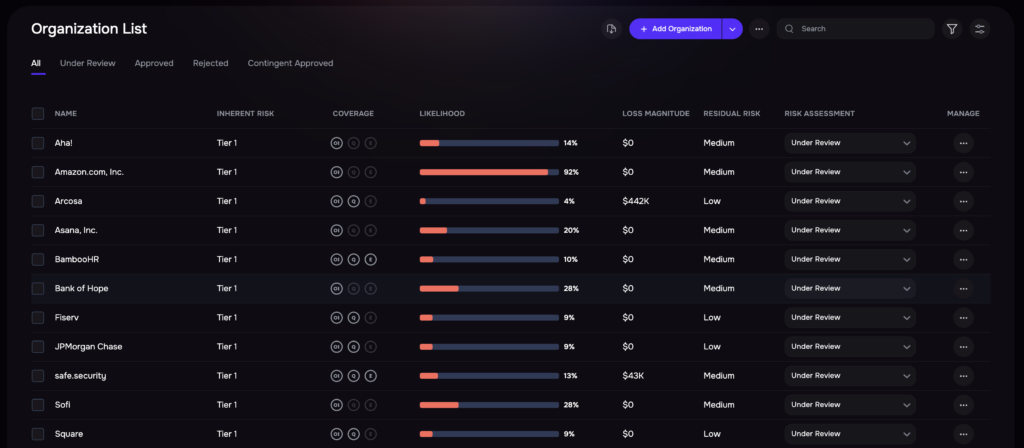

Third party risk assessment on the SAFE One platform

Here’s how the SAFE TPRM platform aligns with key aspects of the mandate:

Comprehensive Third-Party Risk Assessment Made Easy

SAFE’s TPRM solution equips FRFIs with tools to perform in-depth risk assessments. Customizable templates aligned with OSFI guidelines streamline the evaluation process, ensuring that all critical factors are considered. Automated risk scoring further simplifies risk analysis, providing an objective perspective on potential vulnerabilities.

This approach not only meets OSFI’s expectations for risk management but also empowers organizations to make informed decisions about the criticality of their third party engagements, in line with OSFI’s expectations.

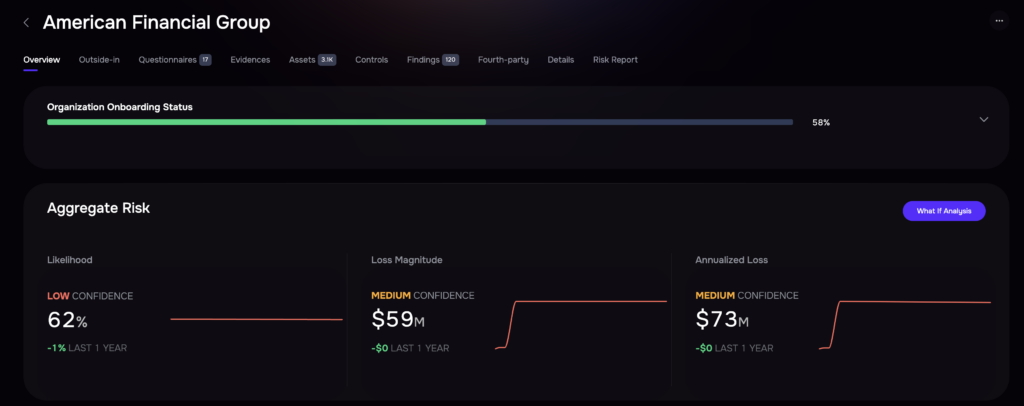

Real-Time Monitoring and Reporting for Proactive Third-Party Management

A standout feature of SAFE’s platform is its real-time monitoring capability. Continuous oversight is crucial in today’s fast-paced digital landscape, where risks can evolve overnight. The platform’s real-time dashboards offer unparalleled visibility into the risk posture of third-party or supply-chain partners, allowing for swift action when necessary. Automated alerts keep teams informed of any shifts in risk levels or compliance statuses, supporting proactive management and swift response strategies generated through AI.

Seamless Integration with Existing Frameworks

One of the common challenges faced by FRFIs is integrating new tools with existing systems. SAFE addresses this with API-based integration that connects to current Governance, Risk, and Compliance (GRC) systems. A flexible architecture not only aligns with institution-specific risk appetites and policies but also ensures a smooth transition, minimizing disruption while enhancing security frameworks. SAFE TPRM also supports mapping third-party risks to enterprise risk management frameworks.

Criticality Assessment Tools for Maintaining Resilience

OSFI’s guidelines emphasize the need to evaluate the criticality of third parties. SAFE’s solution provides robust tools for this purpose, enabling FRFIs to categorize and prioritize relationships based on criticality and risk levels. These features ensure that high-risk and critical partnerships receive the prioritization they deserve, allowing for tailored workflows that address their specific risk factors effectively.

Supporting Continuous Improvement in Risk Practices

The dynamic nature of risk necessitates continuous improvement in management practices. SAFE’s platform supports this evolution through historical data analysis, which helps identify trends and assess long-term risk profiles. Benchmarking capabilities allow FRFIs to measure their practices against industry standards, highlighting areas for improvement. Furthermore, regular updates to assessment criteria ensure that organizations remain aligned with regulatory changes, keeping their risk management strategies current and effective.

Fostering Greater Resilience and Operational Integrity

By leveraging SAFE’s comprehensive TPRM solution, FRFIs can confidently ensure compliance with OSFI’s Guideline B-10. The platform not only addresses immediate regulatory needs but also enhances the institution’s overall approach to risk management. This dual benefit fosters resilience within the organization, fortifying its defenses against potential threats while maintaining seamless operations across the enterprise ecosystem.

Meeting the Letter and Spirit of Guideline B-10 for Third-Party Risk Management

OSFI directs FRFIs to set out “clear accountabilities, responsibilities, policies, and processes for identifying, managing, mitigating, monitoring and reporting on risks relating to the use of third parties.” SAFE’s TPRM solution provides a CISO with a unified view of first- and third-party risk that not only aligns with OSFI’s mandates but enhances overall risk management practices that strengthen security posture, foster resilience, and stay ahead of evolving regulatory requirements.

Explore SAFE’s TPRM solution today – or jump right in and schedule a demo.