SAFE Named to FinTech Global’s List of 100 Most Innovative Insurance Technology Companies

“Widespread plaudits” from insurance experts for our AI-driven cyber risk management platform

FinTech Global, a leading information source for the financial services industry, awarded SAFE a place on its InsurTech 100 list of most innovative providers of technology to insurance companies.

“These are the companies every leader in the insurance industry needs to know about as they consider and develop their digital transformation strategies,” FinTech Global says.

Some 2,100 companies competed for a place on the list, judged by a panel of industry experts and analysts. “SAFE earned widespread plaudits for its AI-driven cyber risk management platform, providing real-time insights and recommendations that help insurers align security strategies with business objectives—critical in today’s increasingly digital world,” FinTech Global writes.

“We’re honored to be named to the InsurTech 100 for a second year in a row as we continue to drive this paradigm shift in how the industry underwrites cyber risk,” says Steven Schwartz, VP, Insurance Strategy & Underwriting, SAFE.

“We view cyber insurance underwriting as the world of 2015 versus 2025. Standard practices are still stuck in 2015 with ‘outside-in’ security assessments and subjective questionnaires unique to each market participant.

“What we’re driving is the notion of ‘quantitative, inside-out underwriting.’ In a matter of minutes, we integrate to an organization’s cloud, SaaS, and cybersecurity products via read-only APIs to drive a much more efficient and objective cyber underwriting process and relationship between the insured and the insurance ecosystem.”

SAFE Is Revolutionizing Insurance Underwriting

SAFE offers a suite of services and integrations that together solve for the longtime barriers and lack of transparency that constrain the insurance industry’s profitability and sustainability. Traditional cyber insurance underwriting is broken: Outside-in scans don’t work, and questionnaires are prone to errors.

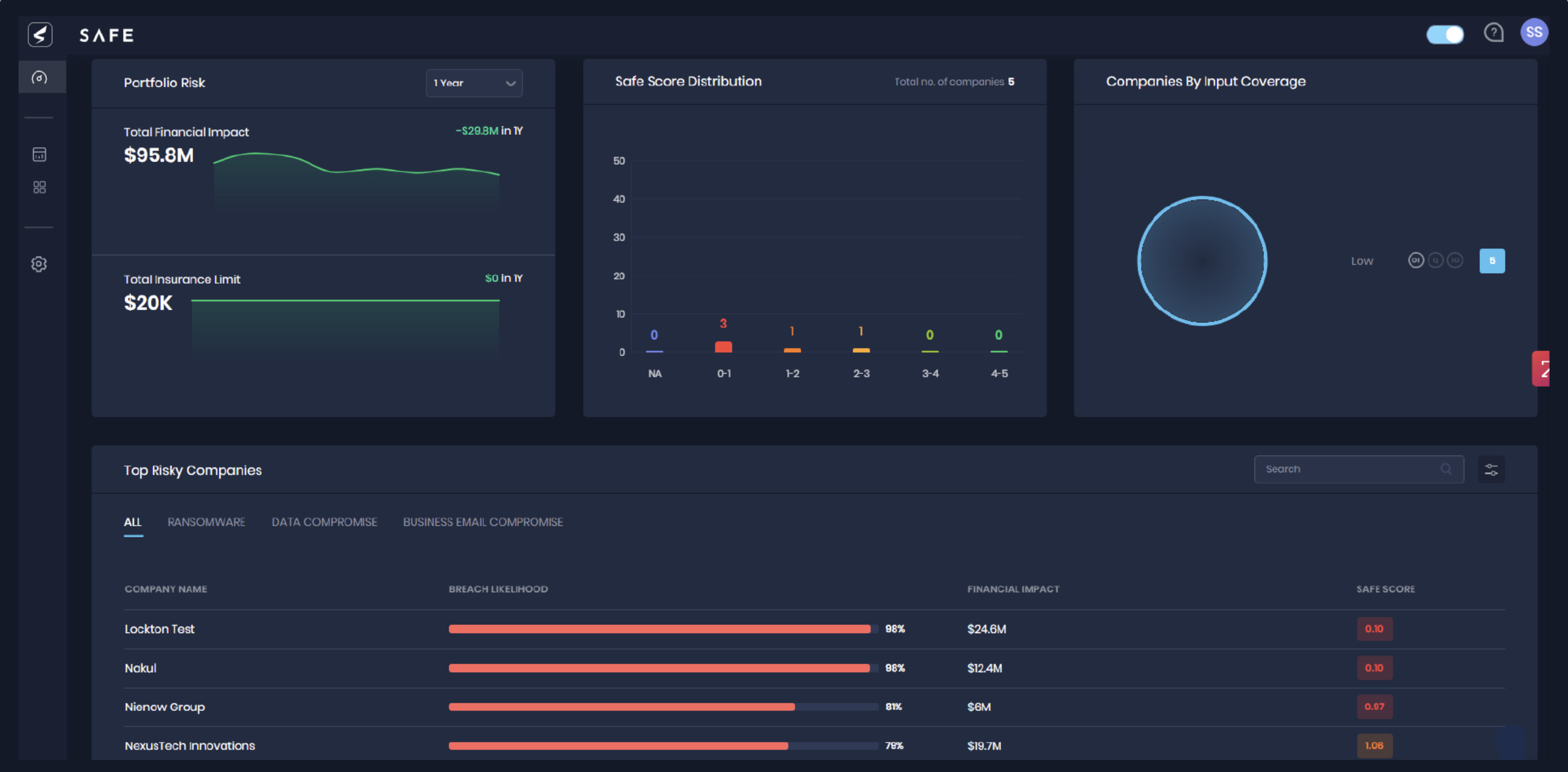

SAFE is revolutionizing underwriting with our SAFE solution. Our groundbreaking technology non-intrusively assesses cyber risk on an inside-out basis to better understand an organization’s real-time breach likelihood across a variety of cyberattacks, the transparent dollar-value risk per attack, plus any specific security gaps that could impact overall cyber risk exposure and underwriting.

Key Benefits of the SAFE Cyber Insurance Underwriting Solution

- Automates the application mapping and analysis process with AI

- Reduces subjectivity and uncertainty in underwriting with a data-driven approach

- Real-time risk assessment

- Transparency: A single view of risk on a common platform for carriers, brokers and end customer

- Unlocks premium discounts for customers who agree to use the SAFE risk management platform.

SAFE answers common underwriter questions with unprecedented accuracy:

- Does the client have MFA enabled? On how many assets? Inside-out telemetry gives definitive answers.

- What is the client’s business interruption exposure in real terms? Is coverage adequate? We translate security controls into financial exposure for accurate underwriting.

- What is our portfolio exposure on AWS? Or to a new CVE? Manage portfolio risk at a granular level and in real-time.

SAFE’s SAFE Platform Gaining Rapid Acceptance

In the news:

Mosaic & Other Lloyd’s Syndicates Partner with SAFE (May 28, 2024)

Incyde Risk, a new cyber facility powered by SAFE, led by Mosaic 1609, and supported by other participating Lloyd’s syndicates, has launched to provide up to $25 million in capacity on a primary and first-excess basis, focusing on mid-market US corporate risks.

“The partnership is profound, as it pairs expert underwriting with highly specialized risk assessment and quantification,” said Mark Wheeler, Co-CEO of Mosaic. “SAFE is the de facto industry standard to measure, manage, and transfer cyber risk, and its resulting analytics allow enhanced risk selection combined with objective client differentiation. Such a dynamic scenario equips Incyde Risk to deliver preferential coverage and pricing that reflect individual clients’ demonstrable commitment to cyber security.”

Learn more about SAFE’s SAFE solution and next generation cyber risk quantification and underwriting. For more information, contact us at [email protected].