SAFE Partners with Howden, Mosaic Insurance, Chubb, Liberty Specialty Markets to Bring Faster Underwriting, Better Terms to Cyber Insurance

SAFE platform incentivizes security investments to reduce premiums

by SAFE

SAFE, the pioneer of quantitative, inside-out risk assessments for cyber insurance underwriting, has partnered with Howden, a leading global insurance intermediary group, to create Howden SAFE+, a cyber insurance solution aimed at clients with revenues above $250 million.

Howden SAFE+ combines Howden’s global broking expertise, SAFE’s advanced risk-management platform, and innovative underwriting of complex risks by Chubb, Mosaic Insurance and Liberty Specialty Markets to simplify the process of purchasing cyber insurance.

Read the SAFE+ announcement from Howden.

Key benefits of Howden SAFE+:

- Reduces required number of underwriting questions for a quote by 30% compared to competitors

- Correlates cybersecurity improvements with the terms of cyber policies, incentivizing clients to invest in security measures and improve their risk posture

SAFE Brings Ground-Breaking Technology to Cyber Insurance Underwriting

Standard practices in underwriting have been stuck in the past with the primary tools 1) outside-in security assessments for a limited view of an organization’s controls and 2) questionnaires yielding a point-in-time, subjective view of security posture.

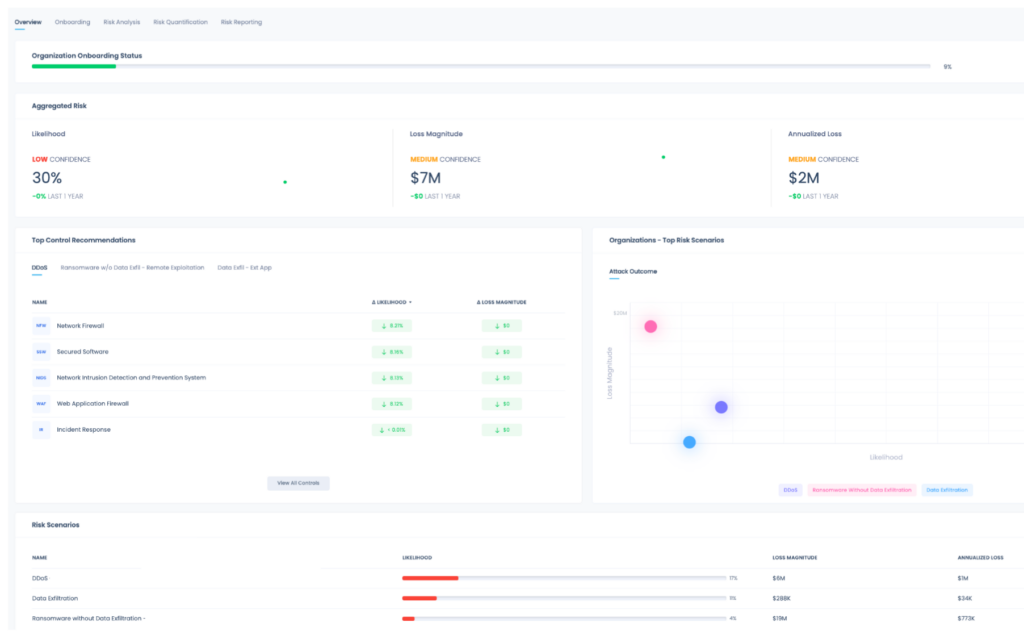

SAFE’s groundbreaking technology non-intrusively assesses cyber risk on an inside-out, continuous basis to better understand an organization’s breach likelihood across a variety of cyberattacks, the quantified financial exposure of each attack, and the security gaps that could impact overall cyber risk exposure and underwriting.

Comments from the Partners in SAFE+

Jean Bayon de la Tour, International Head of Cyber, Howden

“Following the successful launch of Howden Cyber+ earlier this year, Howden SAFE+ is another proactive, seamless, data-driven solution that safeguards businesses while simplifying the purchasing process. SAFE+ creates a clear, predictable and transparent link between cybersecurity and cyber insurance, ensuring that companies that invest in the latest cyber security measures are duly rewarded.”

James Tuplin, Head of International Cyber, Mosaic

“Mosaic is excited about our partnership with Howden, Chubb and SAFE. We believe inside-out scans powered by SAFE software are the future—they’re the best way to obtain direct, accurate information around an insured’s cyber security posture, and offer far more insightful information—obtained more quickly and efficiently—than the standard application form process. Our streamlined process with Howden offers broader coverage at better terms with up-front incentives—it’s how buying cyber insurance should be done.”

Raheila Nazir, SVP COG Cyber at Chubb

“Chubb is delighted to partner with Howden, Liberty Specialty Markets and Mosaic to launch SAFE+. Together we are helping businesses stay ahead of cyber threats with our collective real-time insights and innovative risk management underwriting.”

Jelmer Andela, Head of Cyber Underwriting, Liberty Specialty Markets

“Liberty Specialty Markets is pleased to support Howden SAFE+, making cyber coverage more accessible while highlighting the value of strong cyber security. This partnership empowers clients to see real benefits from their risk management investments”.

Steven Schwartz, VP, Insurance Strategy & Underwriting, SAFE

“The SAFE+ program in a partnership with Howden sets a new standard in the cyber insurance market. SAFE+ enables a new degree of efficiency, transparency, and trust between customers and insurers. It’s time we move beyond the death-by-paper cut, tedious renewal application process and focus on continuous risk management with unique policy incentives that support the same — This is a defining moment in the cyber insurance market fostering resilience and sustainable growth.”

Risk analysis for cyber insurance by SAFE

FinTech Global, a leading information source for the financial services industry, recently awarded SAFE a place on its InsurTech 100 list of most innovative providers of technology to insurance companies.

Interested in learning more? Contact Us