Leveraging AI to Transform Third-Party Risk Management in 2025

Agentic, autonomous AI provides actionable, risk-based TPRM recommendations in realtime.

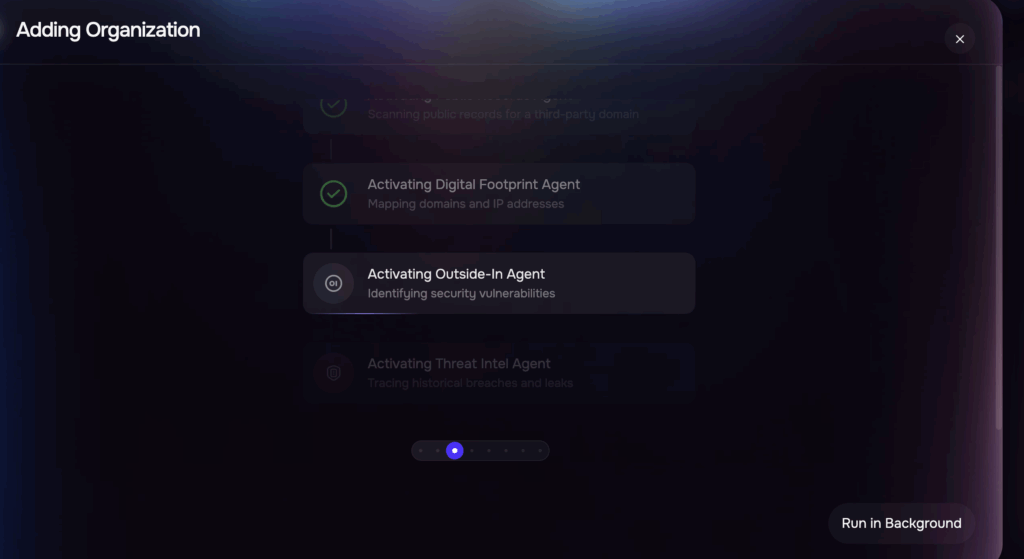

Onboarding with SAFE TPRM platform

In this blog post, we cover

- What is TPRM and Agentic AI?

- What Is the Current Role of AI and Agentic AI in TPRM?

- Benefits of Agentic AI: Risk detection, scalability, and compliance

- Quantitative Risk Analysis for TPRM: Data-driven insights for smarter decisions

- Future Trends: What innovations will shape AI-driven cyber risk management?

AI and third-party risk management are now fundamentally linked for organizations looking to stay ahead in today’s digital environment. But the real game-changer isn’t just monolithic AI —it’s Agentic AI: task-specific, autonomous AI agents engineered to serve business needs across the risk management process.

As companies rely more than ever on third-party vendors and partners, traditional spreadsheets or black-box tools fall short. What makes the difference now is putting purpose-built Agentic AI to work—enabling smarter, automated, more proactive due diligence and continuous supply chain oversight.

AI-powered third party risk management (TPRM) built on Agentic AI doesn’t just automate old processes. These AI agents are created to handle targeted tasks—like supplier onboarding, risk assessments, or anomaly detection—delivering risk-based, real-time insights and catching potential risks that slip through manual reviews.

This is how modern organizations use artificial intelligence: not as a generic add-on, but as a suite of smart, autonomous tools focused on resolving true business challenges. When you deploy AI agents, you save money, time, and resources—while actually driving safer business outcomes.

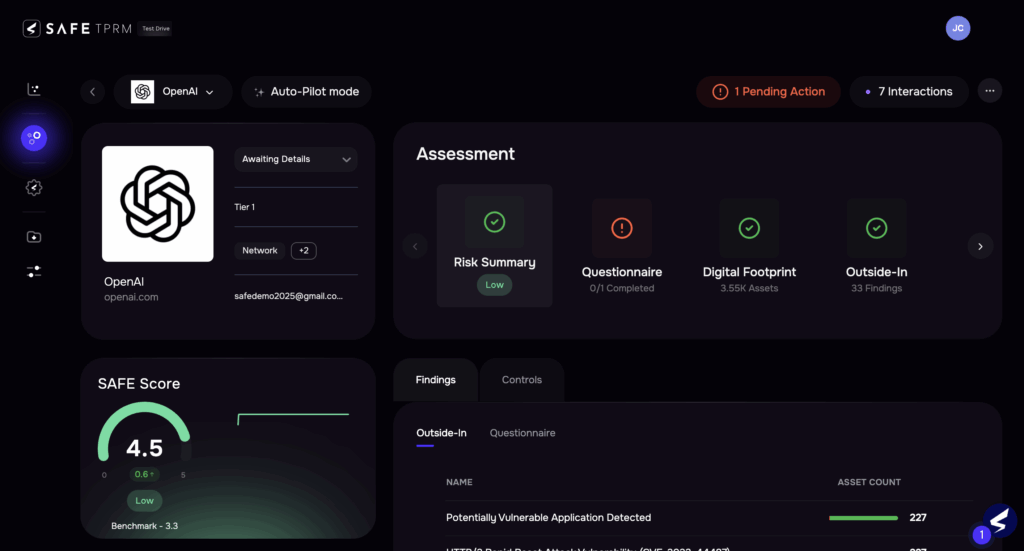

Risk assessment, SAFE TPRM

Understanding Third-Party Risk and the Agentic AI Revolution

What is Third-Party Risk Management?

Third-party risk management means putting systems and strategies in place to manage risk throughout your business’s engagement with third-party (and even fourth-party) vendors, partners, or service providers. It spans every step of the vendor risk management lifecycle—from onboarding and reviewing questionnaire responses to ongoing threat and risk monitoring, to managing operational disruptions or compliance gaps. Without focused oversight, potential loss exposure can run from leaked intellectual property and customer data to operational disruptions to missed regulatory deadlines.

Traditional TPRM relies on manual reviews and occasional risk assessments that can take weeks. That’s not best practice anymore. Today’s sprawling supply chains and never-ending risks demand more. Here’s where Agentic AI—autonomous AI agents purpose-built for continuous monitoring, due diligence, and risk response—reshape the picture. They’re not one-size-fits-all. Each agent is engineered to perform a specific role and, as a team they fill the gaps that manual approaches, particularly based on qualitative judgments, miss. Result: For the first time, 100% visibility across all the third parties.

Why Is Agentic AI a Game-Changer in Third-Party Risk?

Traditional AI processes large amounts of data looking for patterns and makes predictions to output text or other results. Our agentic AI doesn’t just process data—it reasons, collaborates, and delivers enterprise-grade risk-management outcomes. AI agents can interpret, flag, and act—working 24/7 to sift through massive data sources and provide actionable, risk based recommendations in real time. They move with speed and accuracy, closing the distance between vulnerability or incident detection and mitigation across the entire supply chain.

How does this play out for AI and third-party risk management?

- Identifying patterns with agents trained on historical vendor incident data, revealing red flags before they escalate into crises.

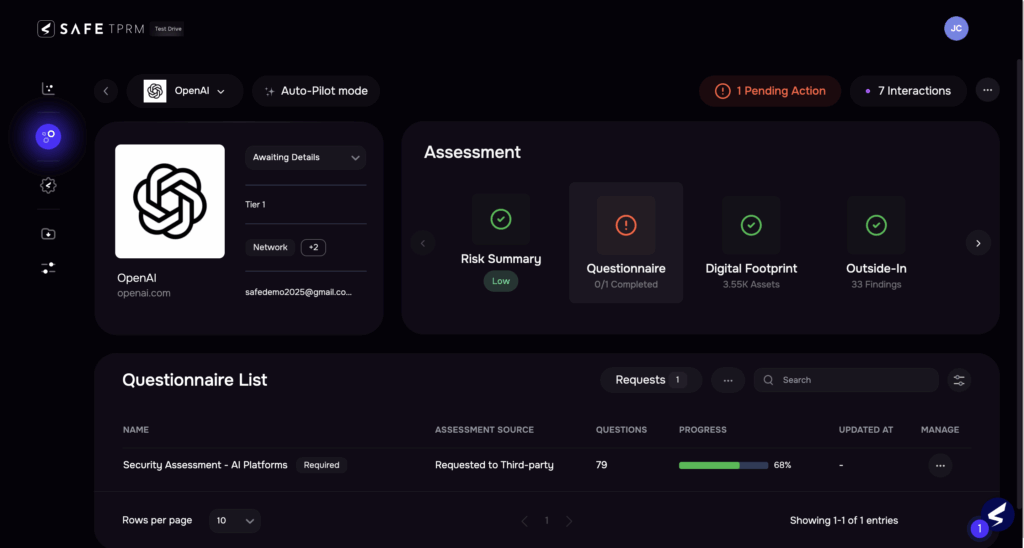

- Automating due diligence—agents digest questionnaire responses, public records, SOC reports, trust center documents and compliance statuses—to dramatically speed up vendor onboarding.

- Triggering real time updates to risk assessments as soon as a new threat or event is reported.

- Persistent monitoring by deploying AI tools and agents to ensure that potential risks and compliance issues are surfaced and handled right away, including autonomous communication to vendors.

- Tiering vendors – automated ranking adjusted for the latest indicators of the risk they pose to the organization.

By deploying Agentic AI, managing third-party risk shifts from reactive firefighting to a proactive, business-aligned strategy.

Vendor questionnaire ingestion by AI agents

Benefits of Integrating Traditional and Agentic AI into Third-Party Risk Management

Enhanced Risk Detection and Predictive Analytics

Manual and even basic AI detection methods just can’t keep up with today’s threat landscape. Agentic AI excels at automating due diligence—using specialized agents to process everything from threat feeds and questionnaire responses to vendor policy documents, uncovering anomalies as soon as they emerge. Machine learning–powered agents specialize in identifying patterns and predicting vulnerabilities, letting you act before incidents hit.

With predictive analytics led by purpose-driven AI agents, teams receive early alerts about supply chain instability, regulatory changes, or shifts in a vendor’s security posture—days or weeks before traditional processes can even spot them. That’s a win for anyone tasked with mitigating risk under pressure.

Scalability and Continuous Monitoring

For enterprises managing hundreds or even thousands of vendors, manual monitoring isn’t scalable. Agentic AI provides always-on, autonomous surveillance—agents working singly and together across your entire supply chain to onboard new vendors, then watch for changes, flag events, and analyze new data as it happens in real time.

Whether an agent is tracking new security certifications, scanning open-source risk signals, or analyzing ongoing questionnaire responses, this type of autonomous monitoring lets you scale up without increasing headcount. True Agentic AI means you don’t just rely on third party information—you validate and respond automatically.

Improving Regulatory Compliance and Reporting

With regulations like GDPR, the NIS2 Directive, and the EU AI Act enforcing more rigorous standards, Agentic AI helps maintain compliance by assigning agents to automate audit trails, check vendor documentation, and flag regulatory changes. Instead of manual, error-prone tracking, you leverage AI agents to manage due diligence documentation, automate compliance checks, and generate defensible, risk based reports.

Autonomous agents also ensure your audit trails are up-to-date, providing clarity and defensibility when regulators come calling.

Why Should CISOs Prioritize Agentic AI in Their TPRM Strategy/Program?

- Complex Ecosystems

Modern businesses work with sprawling networks of third parties that access sensitive data and systems. Agentic AI enables centralized oversight—giving CISOs risk based dashboards, real time alerts, and specific agents to monitor and manage key vendor relationships. With so many doors open to the outside, it takes more than manual checks to keep risk contained.

- Dynamic Risk Landscape

Potential risks are in constant flux. Agentic AI is built for adaptability; agents can update risk assessments and surface new red flags the moment something shifts—be it a new supply chain vulnerability or a regulation update. Efficiency via autonomous AI agents is the only way to keep pace with the speed and complexity of today’s environment.

- Regulatory Expectations

Annual reviews and static controls are no longer sufficient. Agentic AI brings always-on risk monitoring, automated questionnaire analysis, and real time documentation—meeting regulators’ calls for risk based, continuous oversight. Autonomous agents ensure that compliance standards are met and documentation remains audit-ready.

- Efficiency Gains

Agentic AI doesn’t just fix a broken process—it slashes inefficiency. By automating due diligence, onboarding, and risk reviews with agents fine-tuned for those tasks, security teams recover valuable hours each week. From machine learning agents that handle initial vendor vetting to others that auto-remediate risk issues, you redirect time from low-value admin back to high-impact strategy.

- Reporting You Can Take to the Board

By quantifying risk in financial terms, CISOs report to leadership in the language they understand, dollar-denominated loss exposure and return on investment for security improvements.

3 Cautions CISO’s Should Consider for Using AI in Risk Management

Adopting Agentic AI comes with considerations that require a fresh take on risk.

AI Bias, Transparency, and Explainability

AI applications are built on data, and that data must be high quality, unbiased and appropriate to the particular business needs of the organization. Business-ready Agentic AI is designed to be explainable, with audit trails connecting every decision to a clear rationale. Ongoing, strict testing should be in place to ensure accurate, non-hallucinatory results.

Data Privacy and Security Concerns

AI agents often handle sensitive vendor data. They must follow strict protocols—using encryption, access management, and continuous oversight—to ensure your supply chain data remains protected, not leaked to the public, shared with competitors or used to train AI models. Deploying Agentic AI platforms should never introduce new risks.

Governance and Accountability Frameworks

No matter how autonomous your agents, human oversight is key. Clear governance ensures each AI agent’s actions are traceable and every automated due diligence or scoring decision is aligned with business and regulatory needs.

Real-World Use Cases of Agentic AI in Third-Party Risk Management

Use Case 1: Automated Vendor Risk Scoring

Replacing manual review with scoring by autonomous AI agents shaves weeks off onboarding. Organizations using risk-specific agents see questionnaire responses analyzed in real time, so critical red flags are flagged instantly and the riskiest vendors get immediate attention.

Use Case 2: Predictive Risk Alerts for Supply Chain Disruptions

In one case, a manufacturer deployed machine learning agents to monitor supply chain partners and real time events—autonomously alerting the team to geopolitical disruptions so they could act faster and avoid downstream risk.

Use Case 3: AI-Enabled Compliance Monitoring

As regulations shift, businesses depend on AI agents to continuously scan for policy changes, check vendor adherence, and keep audit logs current. With Agentic AI automating compliance, teams spend less time on reporting and more on high-value work.

Use Case 4: Integration with Existing Risk Systems and Processes

You don’t have to start from scratch. Many organizations begin by layering Agentic AI on top of traditional AI, current systems and business processes—using it to automate partner onboarding or questionnaire analysis, for instance. As teams get familiar, they ramp up to predictive risk analytics and fully autonomous dashboards powered by dedicated agents.

What Are the Right Agentic AI Tools for Your Organization?

Generic AI can only take you so far. Opt for platforms that offer a suite of task-specific AI agents focused on third-party risk—automating assessments, monitoring for red flags, and delivering risk based, real time alerts. Prioritize transparency, explainability, scalability, and actual business impact.

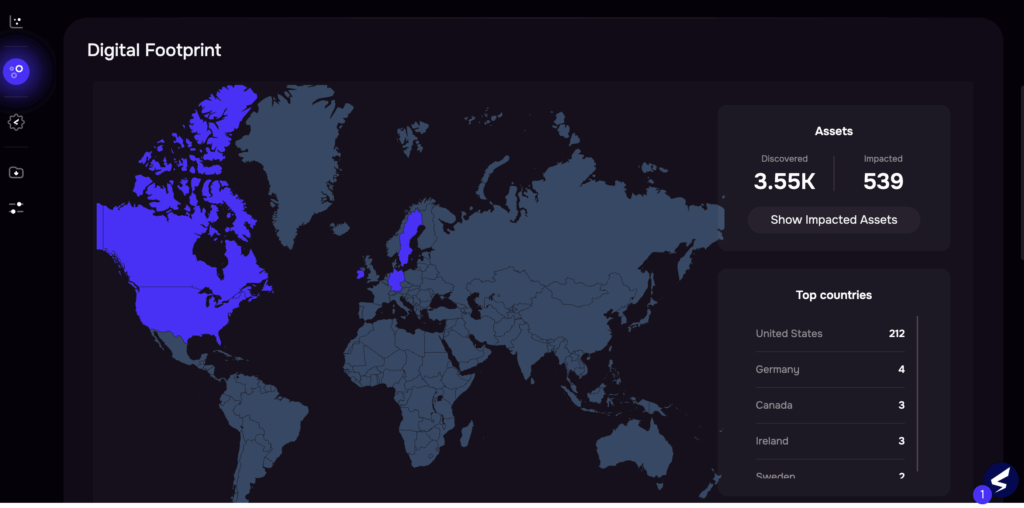

Assessing a vendor’s digital footprint

The Importance of Quantitative Risk Analysis in AI-Powered TPRM

Not all risk analysis is created equal. The real power of AI in third-party risk management comes to life when you pair it with quantitative models. Modern AI-powered TPRM systems can ingest mountains of risk data, financial exposure, and historical loss figures from across your vendor ecosystem and industry-standard data. Instead of relying on gut instinct or vague risk tiers, these platforms deliver instant reads on the likelihood and potential impact of a cyber incident at any given third party.

This is more than a nice-to-have—it’s the cornerstone of confident, data-driven decisions. With quantitative analysis, security leaders get actionable numbers, not just qualitative descriptions. When a new vendor onboards or a critical partner faces a breach, AI can reveal probabilistic loss estimates and prioritize remediation in seconds, not days. Quantitative risk scoring gives teams a defensible, audit-ready basis for every action—from vendor selection to vendor tiering to resource allocation and board reporting. This isn’t just about clarity; it’s about making smarter moves that measurably reduce third-party risk.

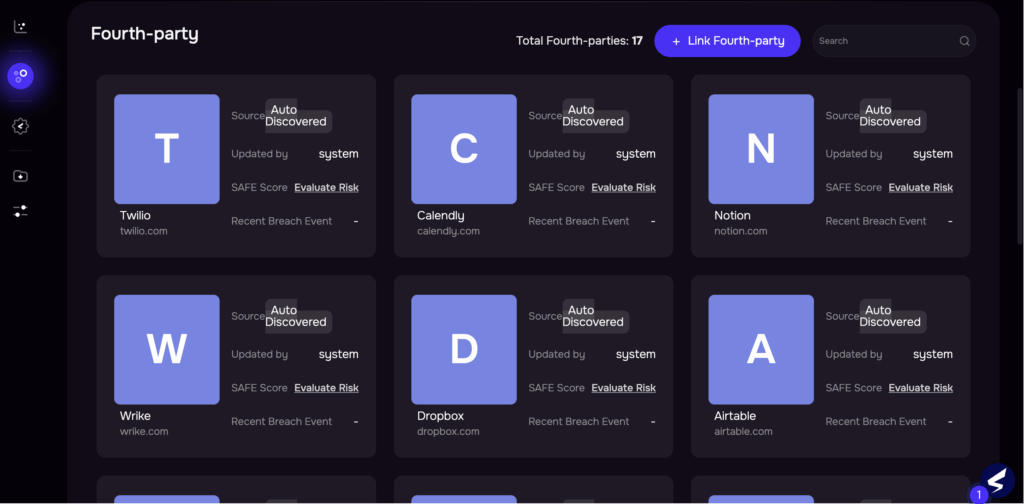

Discovery of fourth parties with AI agents

Future Trends and Innovations in Agentic AI for Third-Party Risk

Next, Look for AI to Power CTEM

Organizations today lack a consistent, cross-platform way to understand how exposed they really are to cyber threats. Traditional Vulnerability Management focuses too narrowly on patching known vulnerabilities in classic IT — while modern threats live in SaaS, cloud, identities, and supply chain systems.

CTEM (Continuous Threat Exposure Management) is a process that helps organizations continuously find, prioritize, and fix security gaps. Powered by Agentic AI, CTEM identifies what matters most, prioritizes based on business impact, and drives remediation without manual effort.

Emerging Agentic AI Models and Their Potential

Next-generation autonomous agents—like those using generative AI to scenario-plan or blockchain to validate supply chain vendors—are redefining risk mitigation and pattern recognition. The future belongs to Agentic AI tightly aligned to business goals.

Academic and Industry Collaborations Driving Innovation

Breakthroughs happen when industry partners with academia to set standards for ethical, explainable Agentic AI. Expect these collaborations to drive smarter, more accountable models for third-party risk management.

Preparing for an Agentic AI-Driven Risk Management Landscape

Getting ahead isn’t about deploying any AI—it’s about adopting autonomous agents purpose-built for each risk management task. Stay curious, invest in training, and look for ways to strategically incorporate Agentic AI throughout your vendor lifecycle.

For third-party risk leaders, waiting isn’t an option. Agentic AI turns potential risks into clear opportunities—and with the right autonomous tools, you can transform risk management from a cost center into a competitive advantage.

How Can SAFE Help You Leverage Agentic AI for Your TRPM Program?

SAFE offers Agentic AI-powered, continuous, and defensible TPRM based on objective telemetry and transparent, open risk standards across the entire attack surface, including third-parties. See our solutions in action – Schedule a demo.