SAFE One for Financial Services

Managing cyber risk to keep money, markets,

and customers safe

Open banking APIs, cloud-native applications, and rapid SaaS integrations accelerate innovation but introduce risks

Disruptions across payment processors, core banking vendors, SaaS platforms leads to customer impact & financial loss

NYDFS, FFIEC, OCC, FDIC, SEC– all demand timely, defensible evidence of incident response readiness & material impact

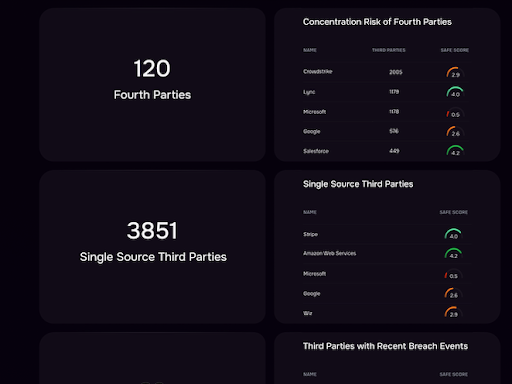

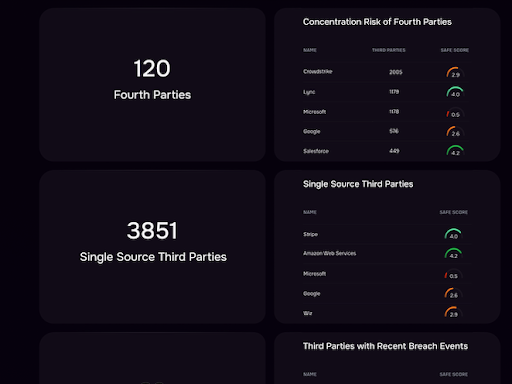

Thousands of external partners, yet little real-time visibility into vendor posture, emerging threats, or critical dependencies

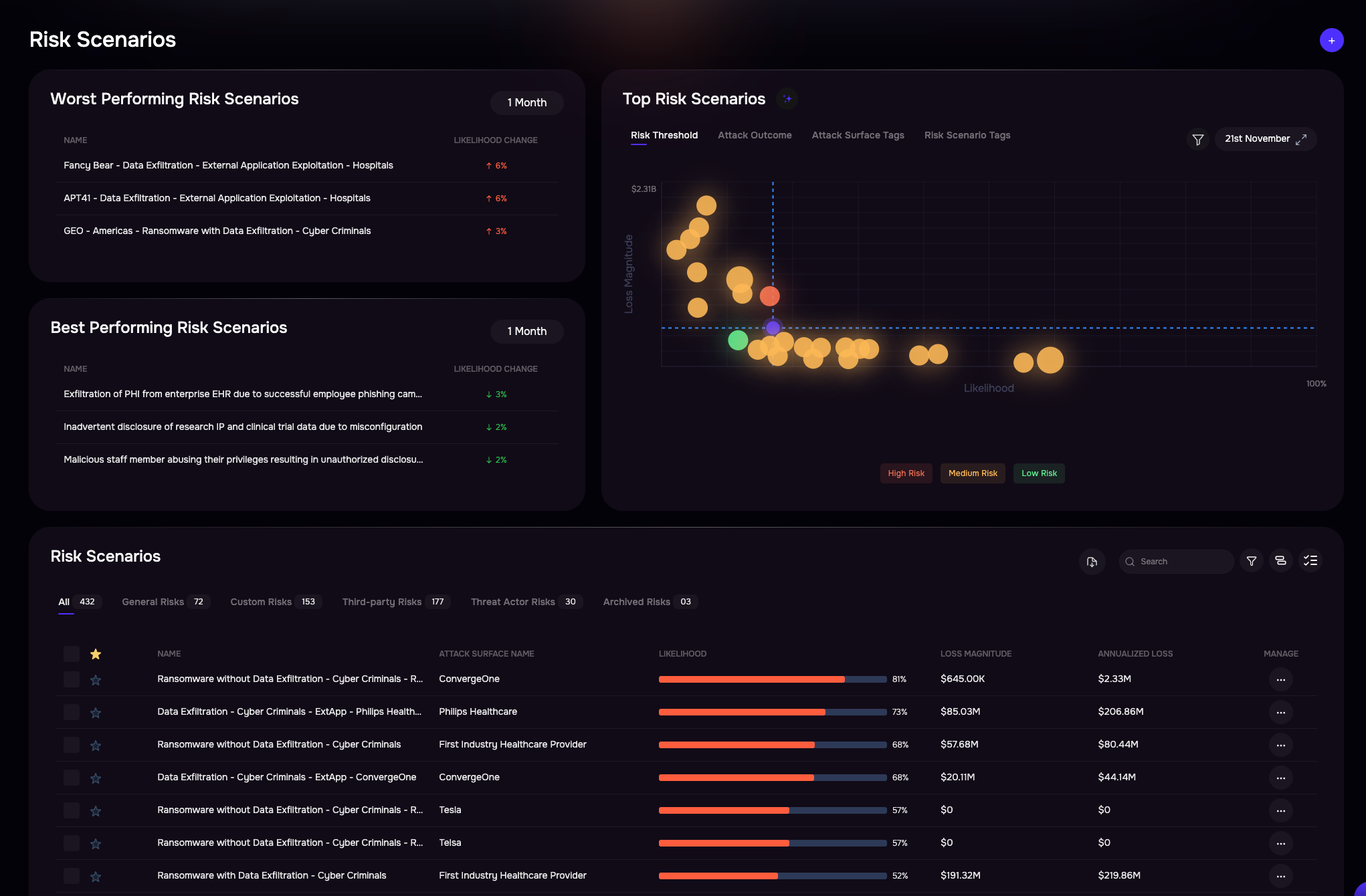

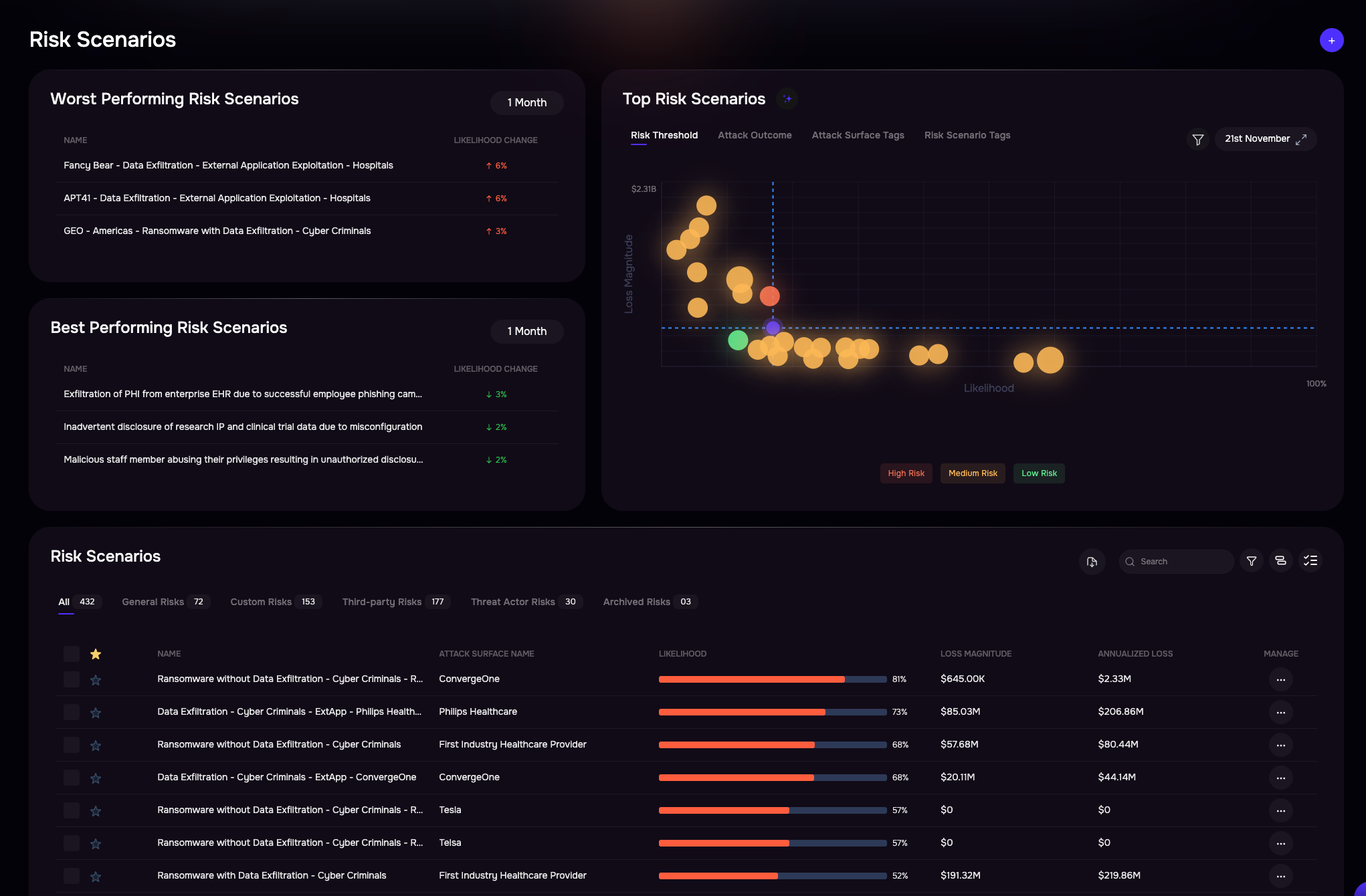

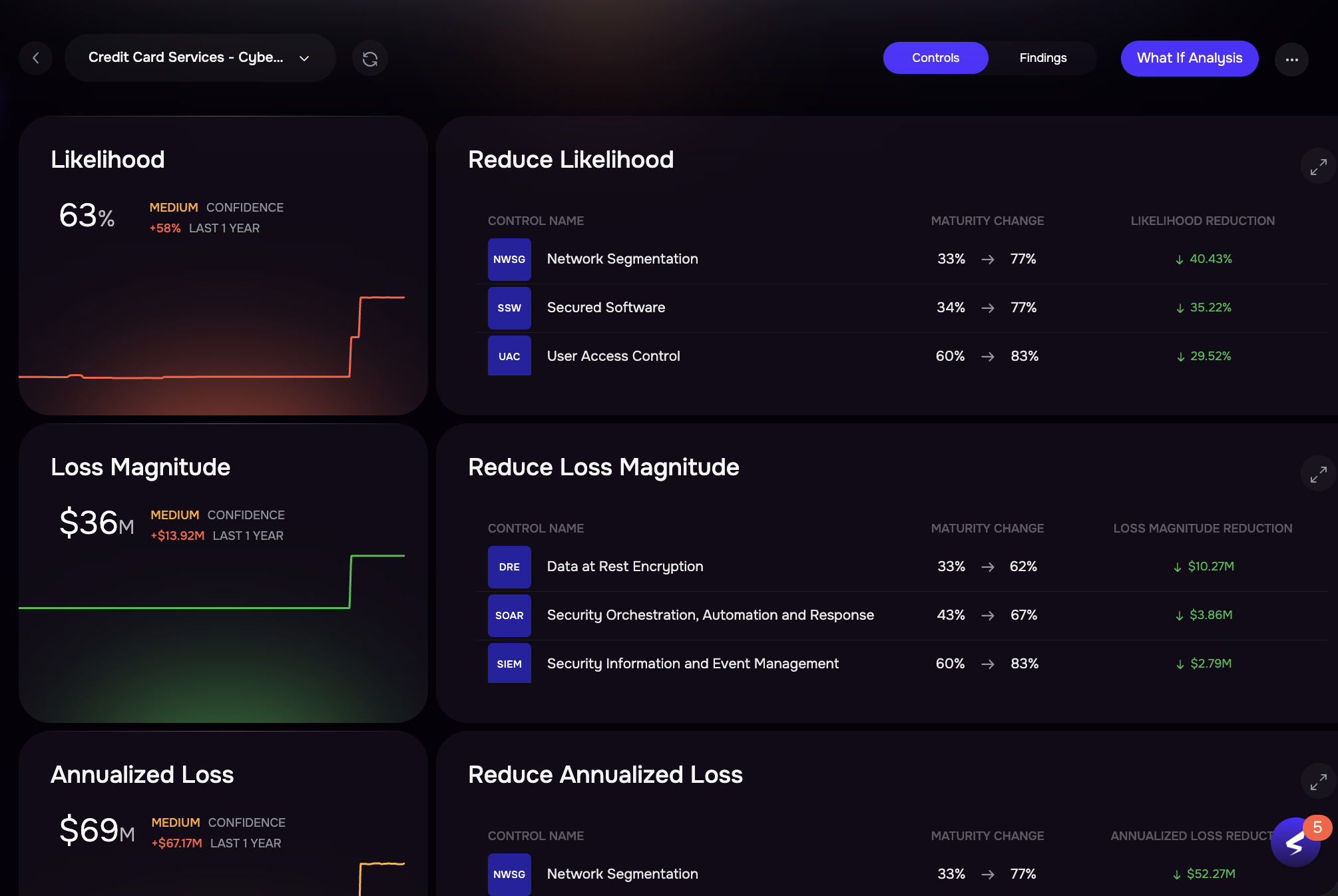

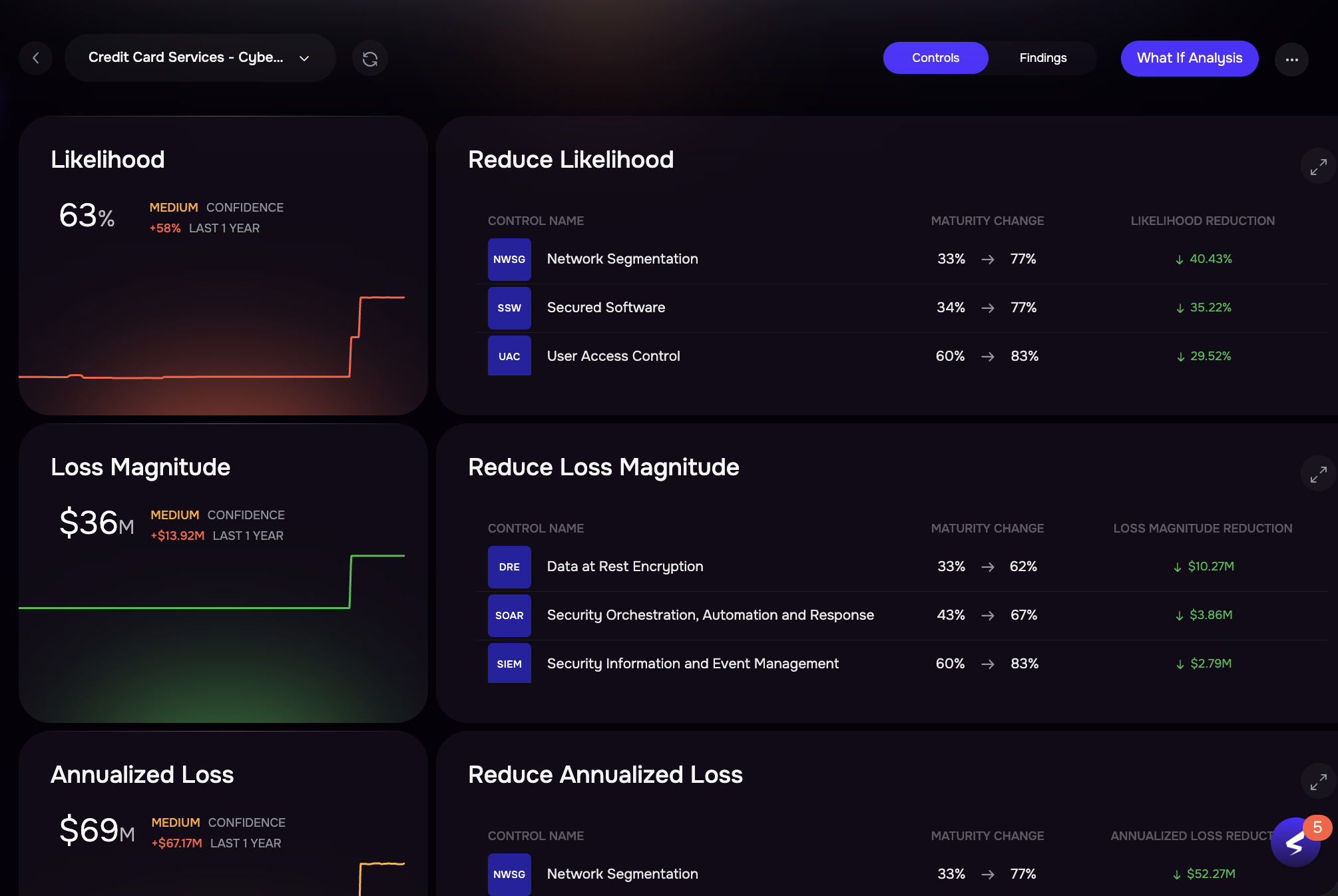

Risk leaders must defend budgets and prove ROI, often without the quantitative insights needed to make investment decisions

Gain continuous visibility into cyber and third-party risk, protect core financial operations, and strengthen regulatory and operational resilience across the institution

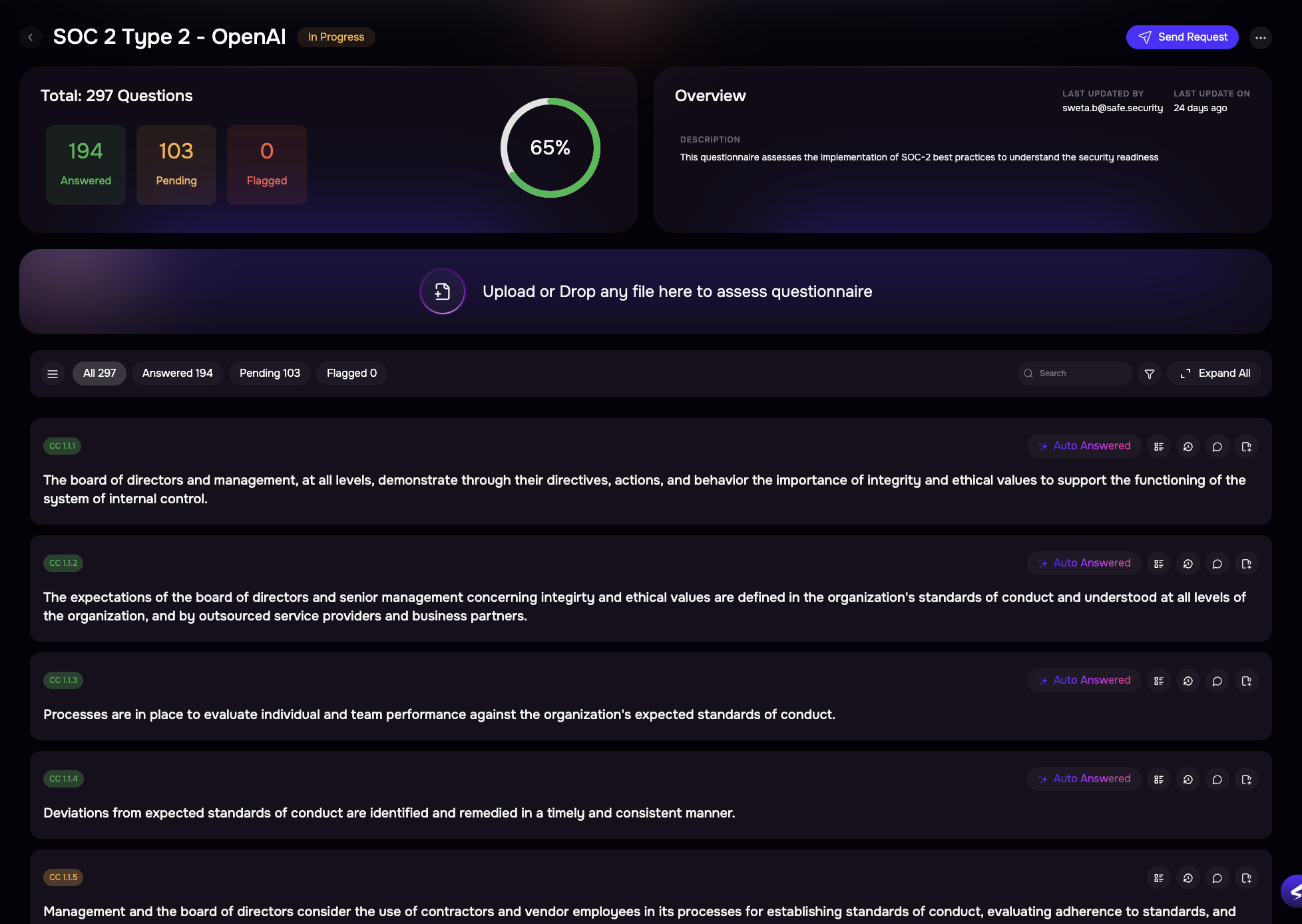

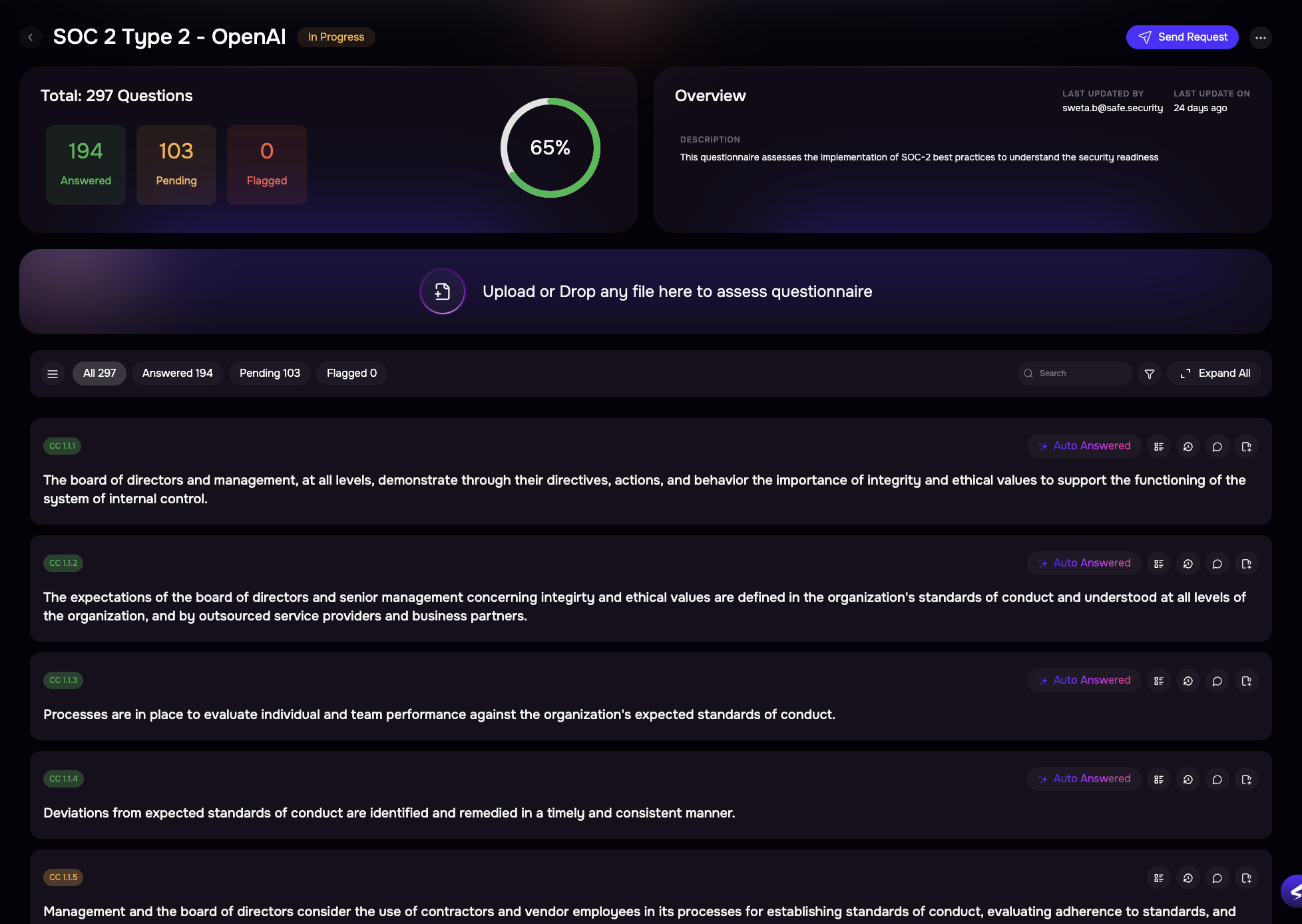

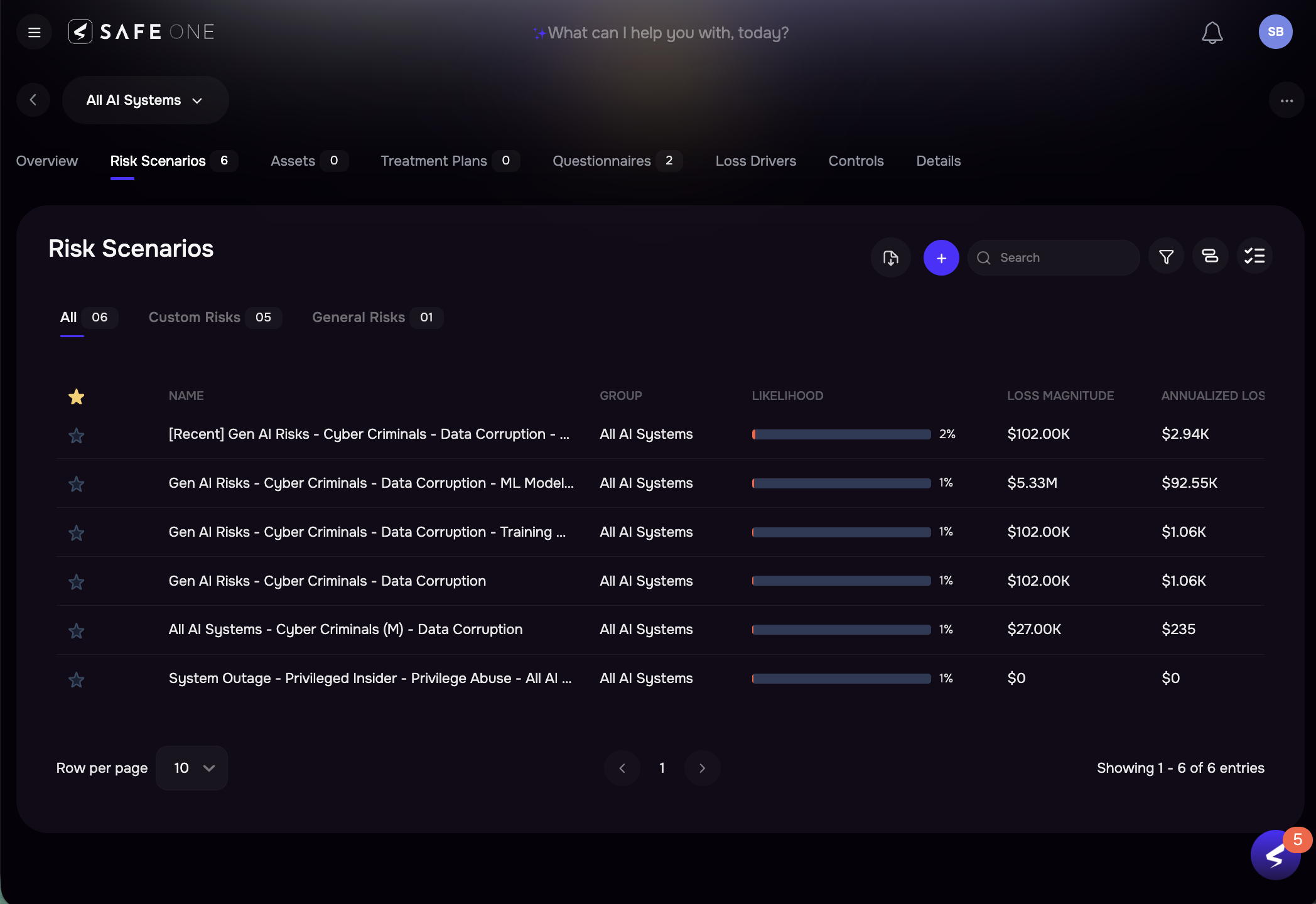

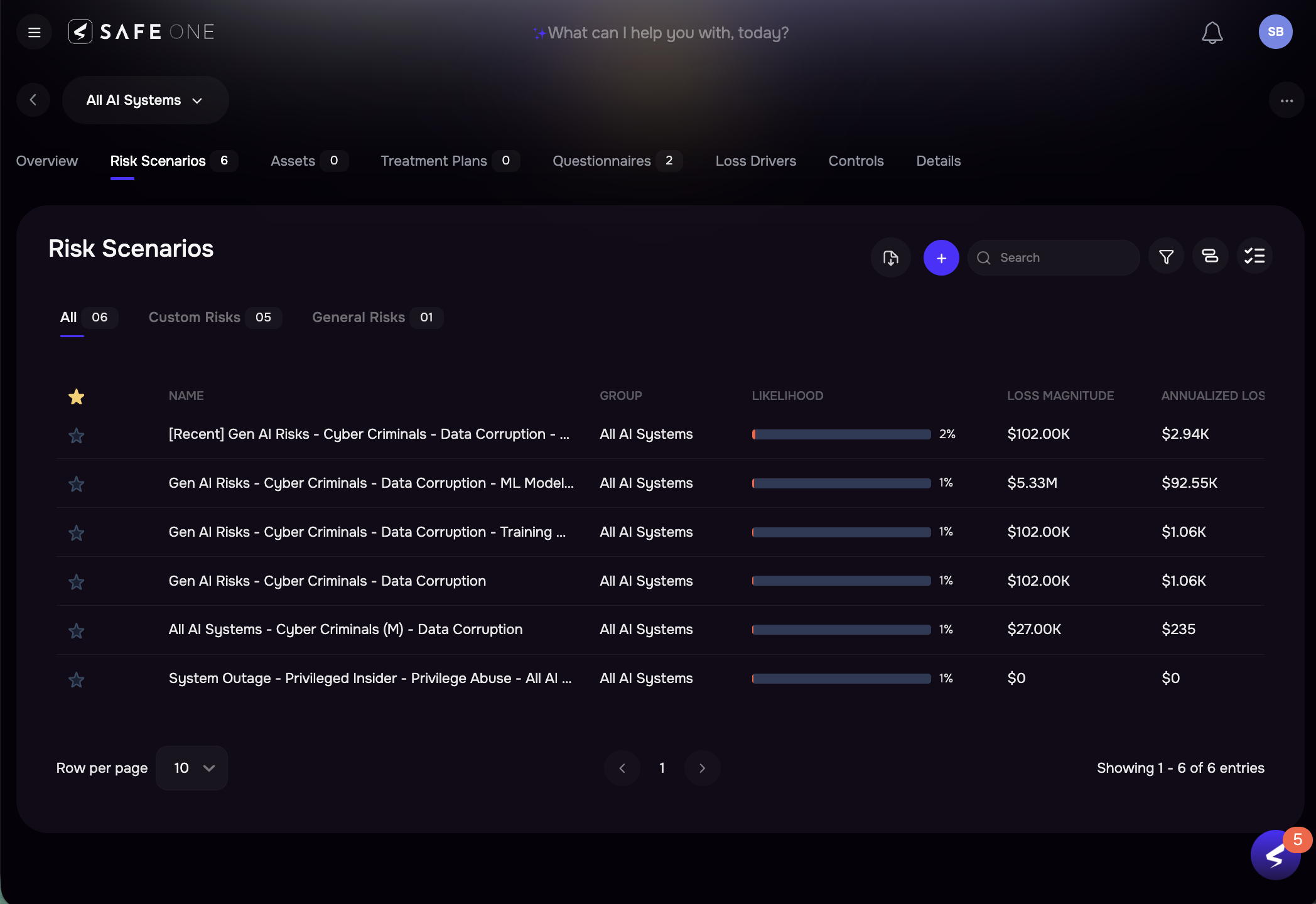

Drive an autonomous TPRM program with real-time visibility, stronger due diligence, and continuous vendor oversight that reduces operational and regulatory exposure

Rapidly assess vendor risk, keep evidence organized and compliant, and ensure high-risk issues are remediated before they impact financial operations