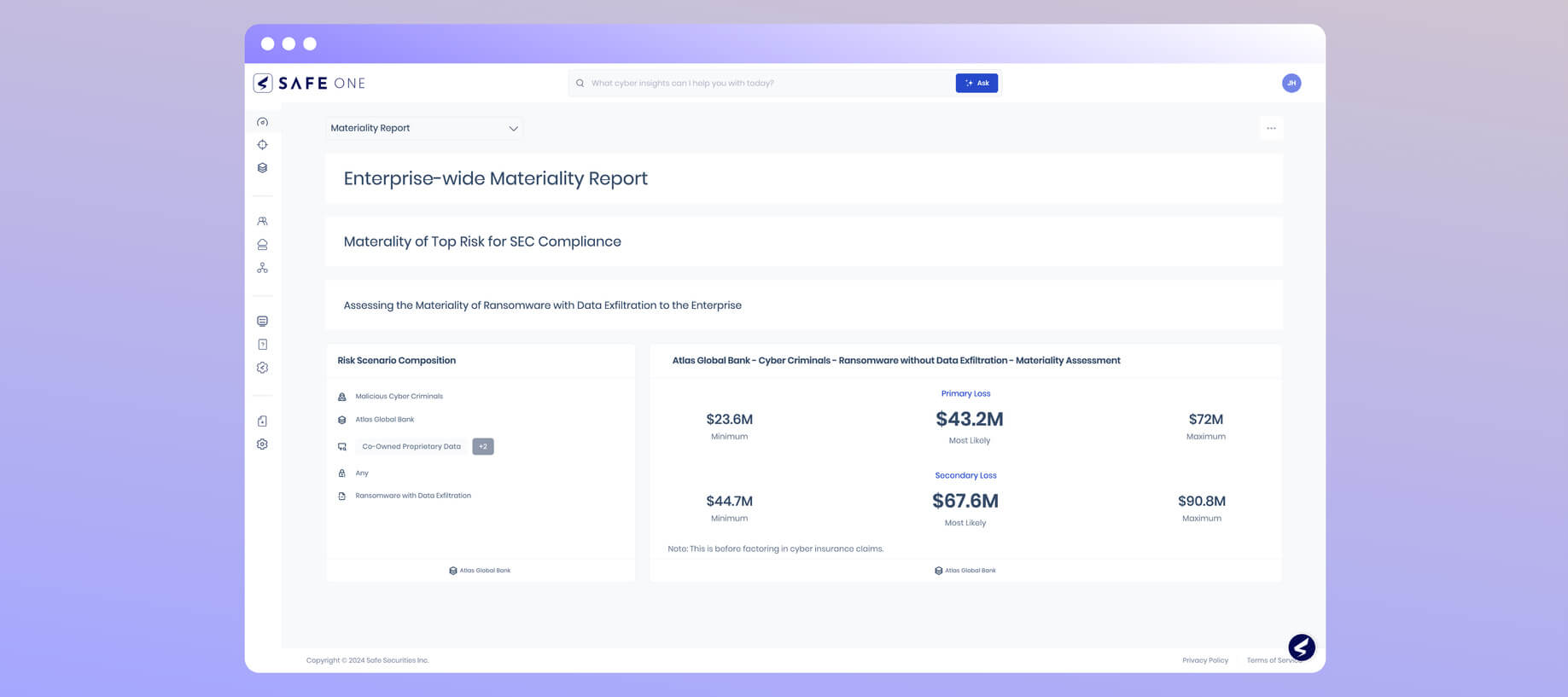

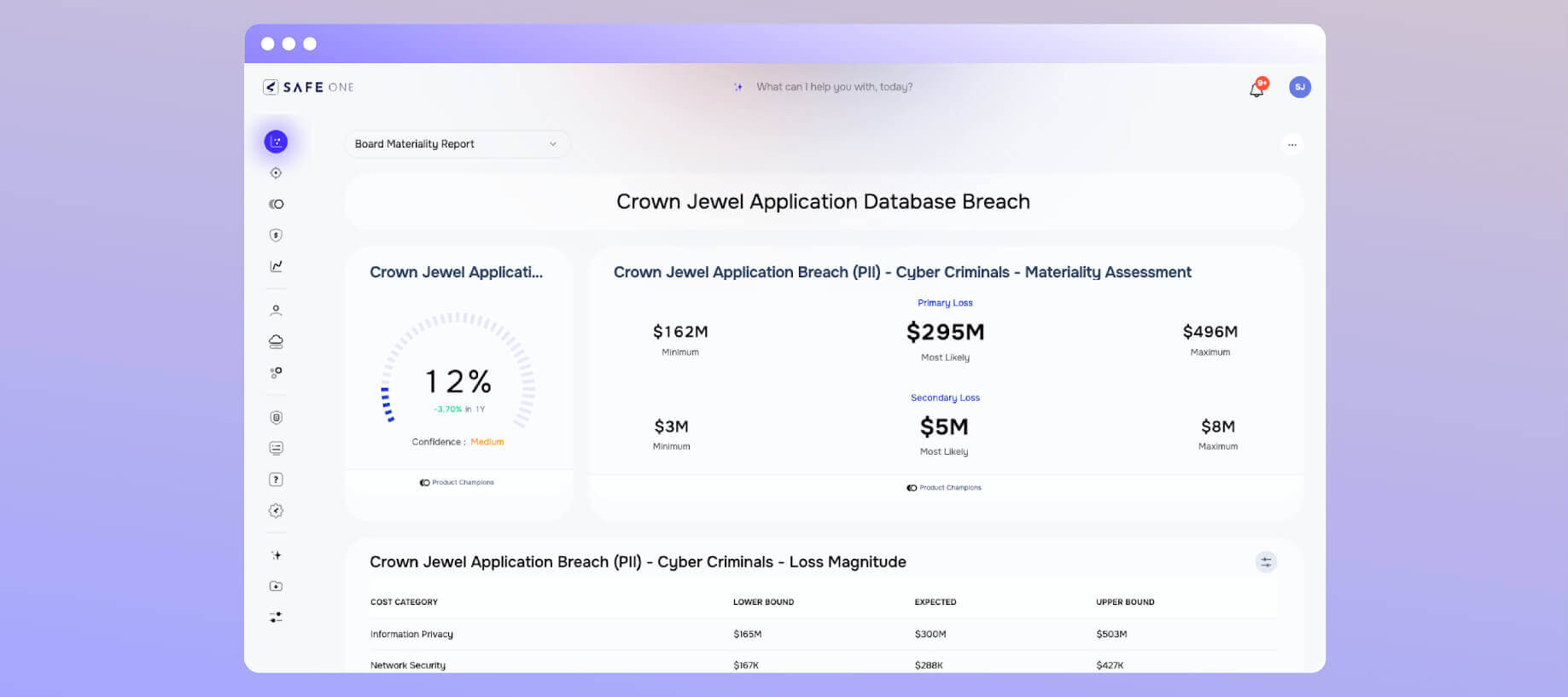

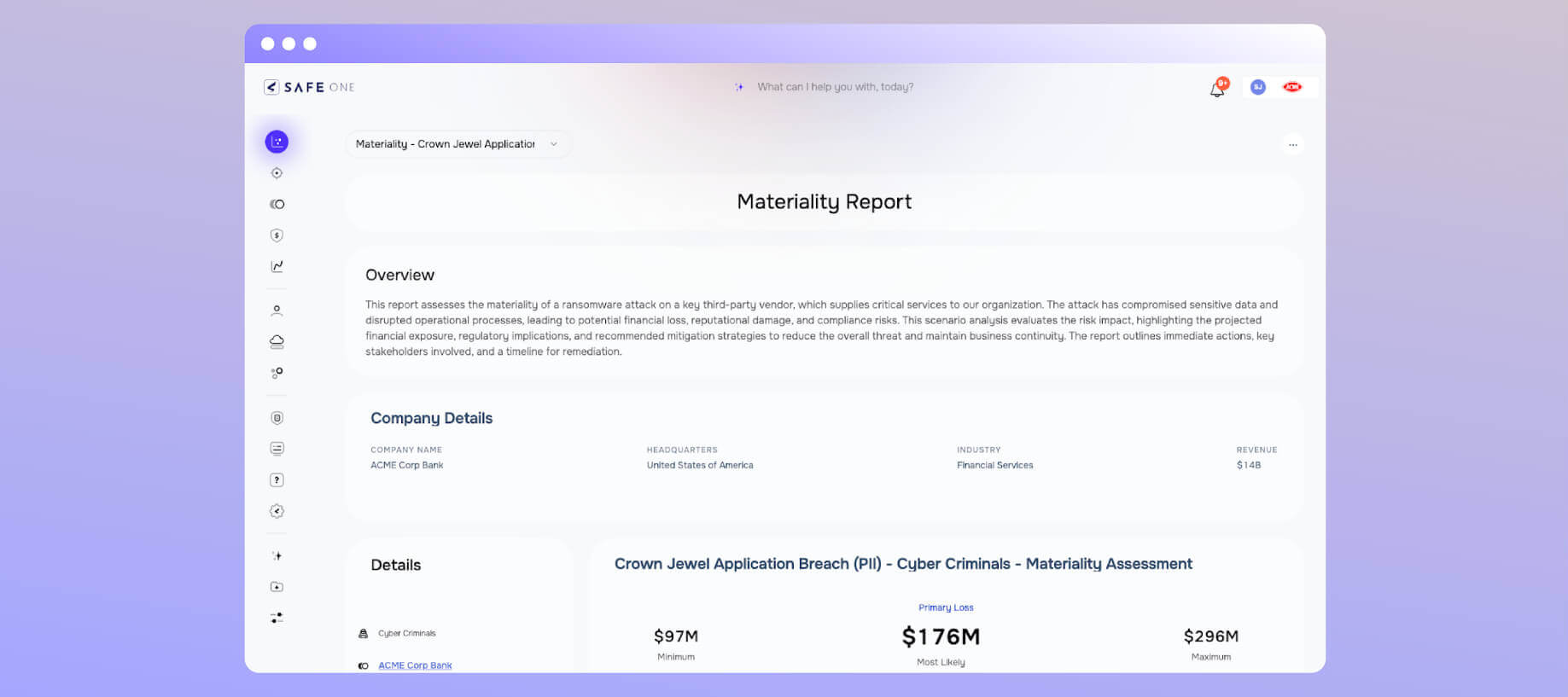

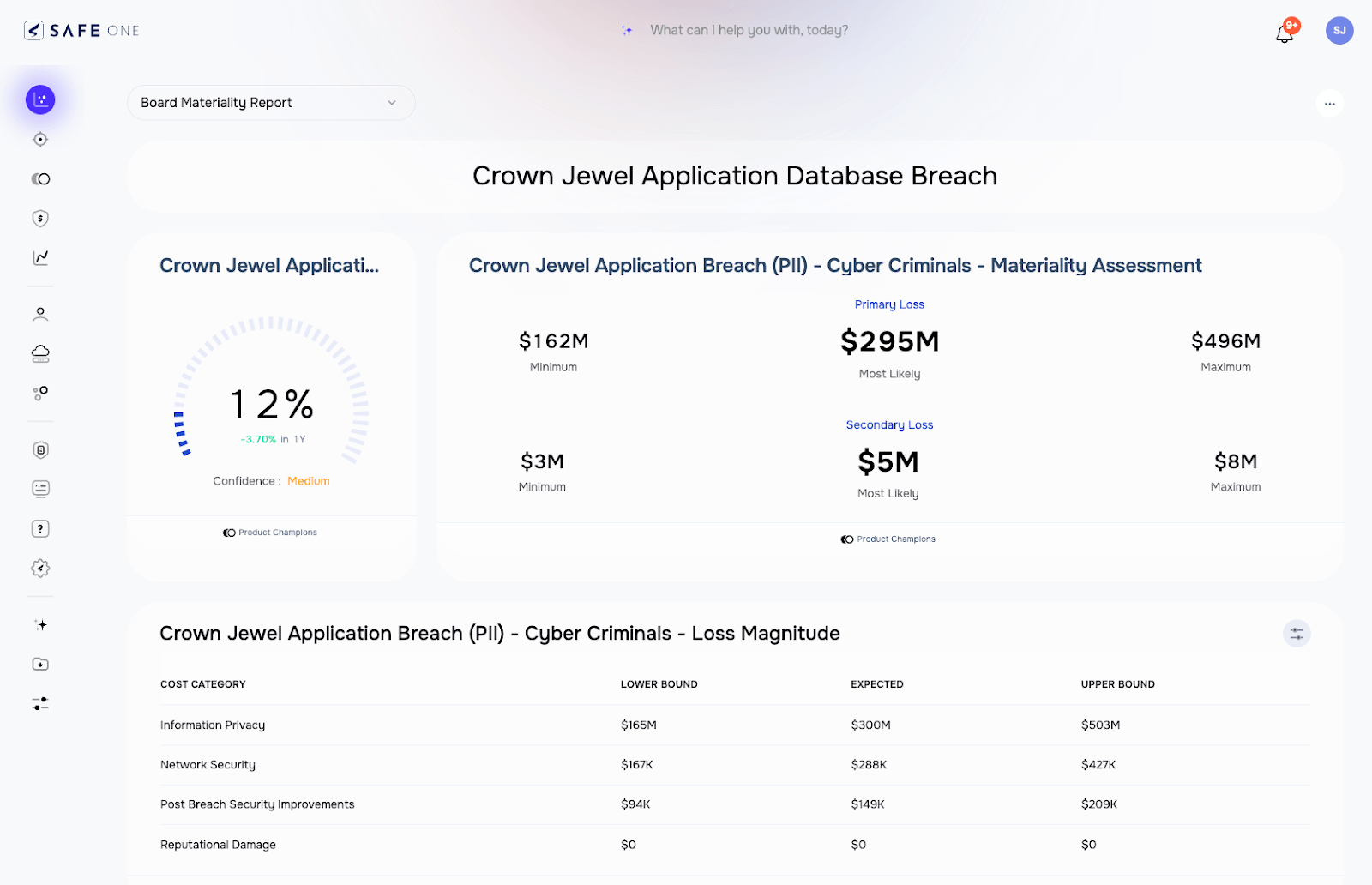

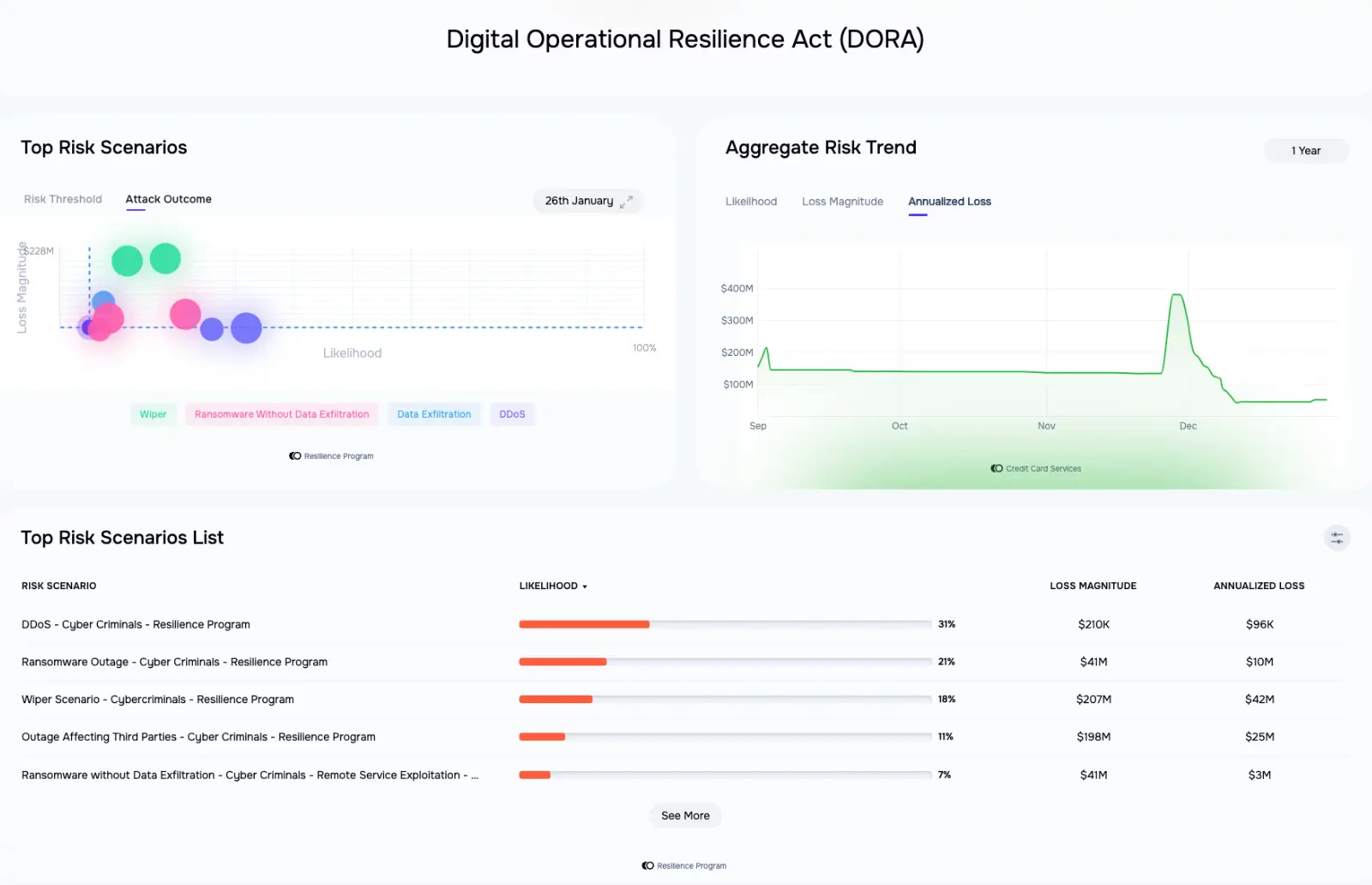

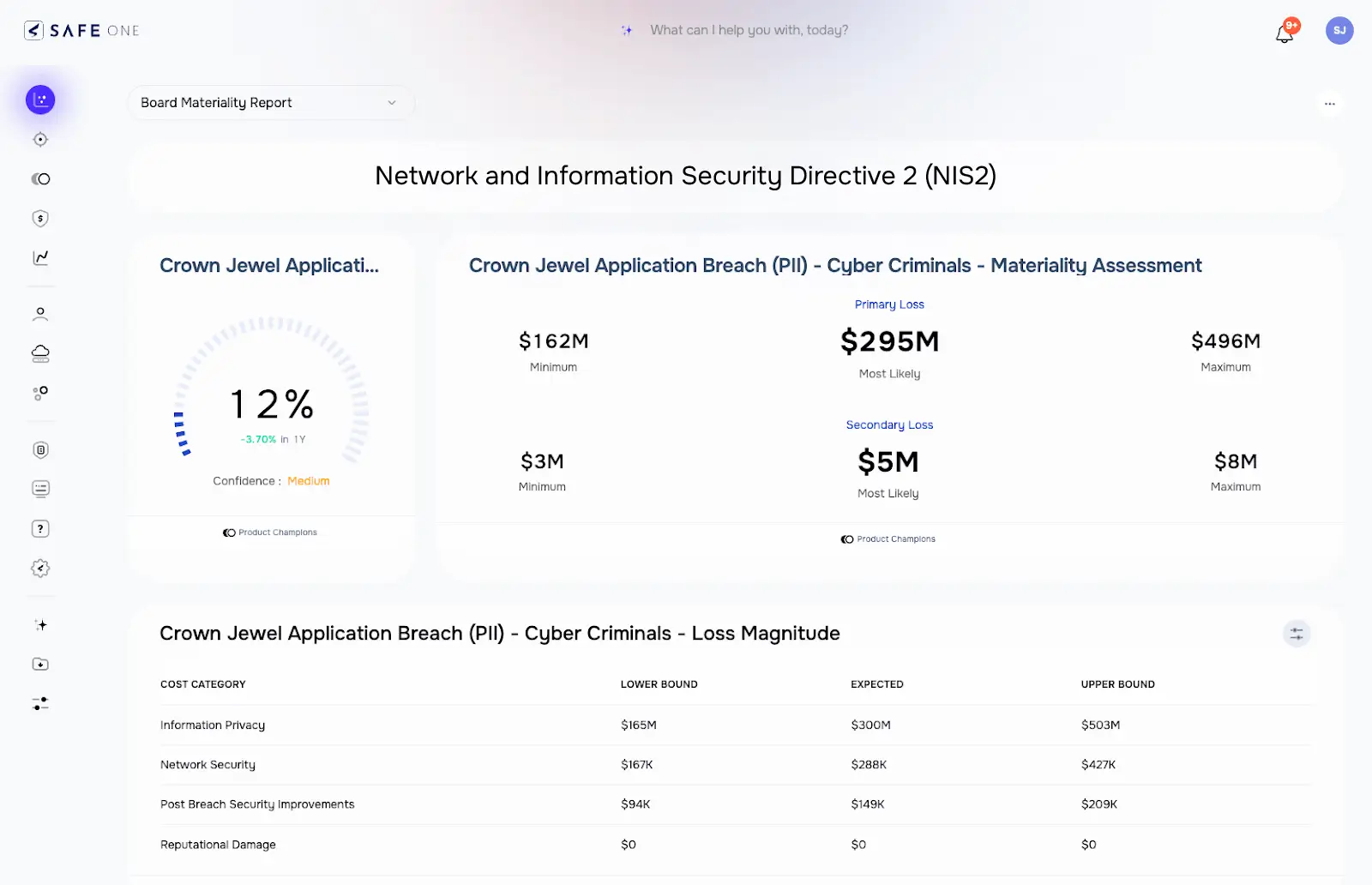

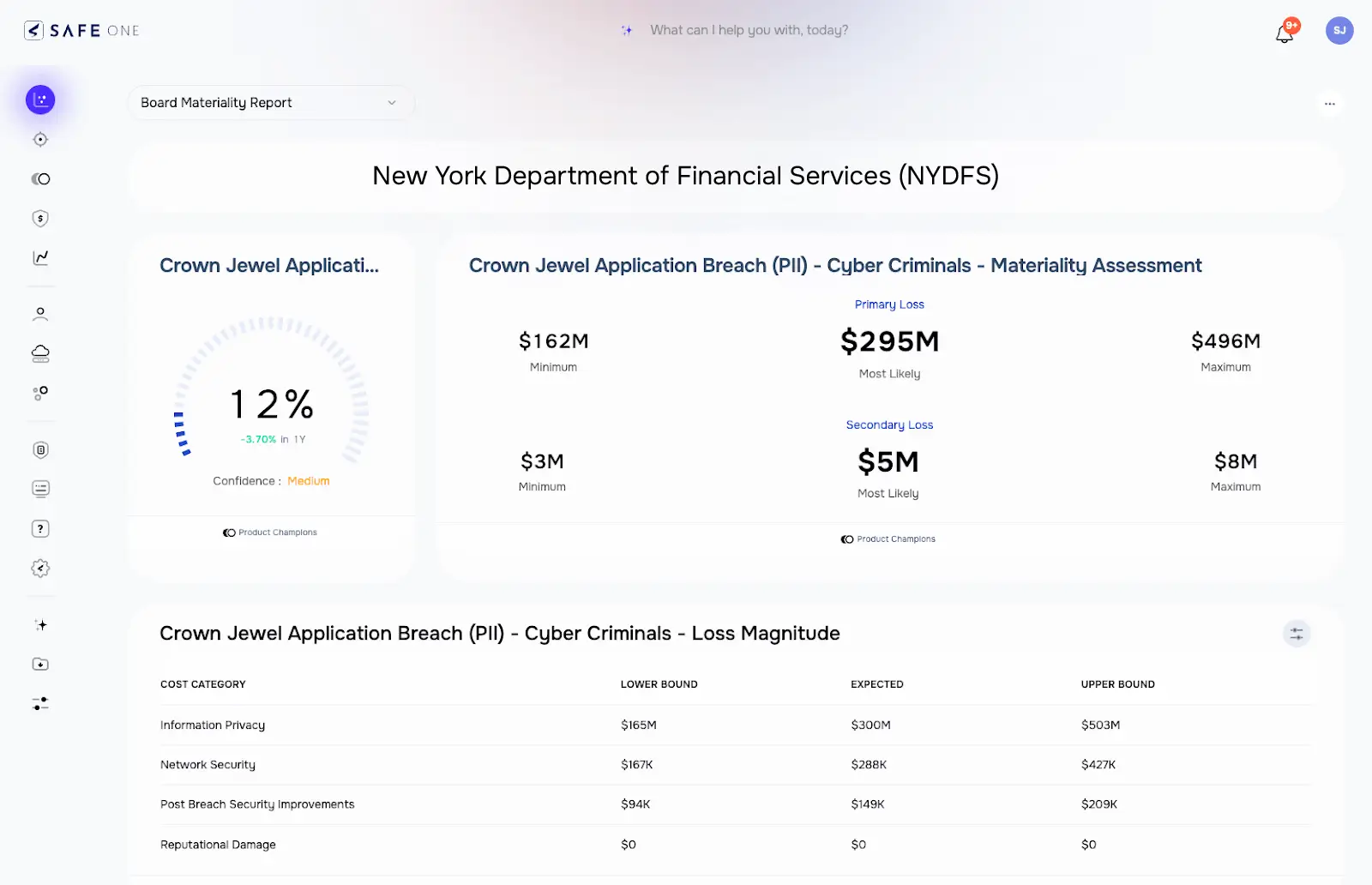

New regulatory mandates like DORA, NIS2, and NYDFS, alongside SEC requirements, are reshaping expectations for large enterprises. Organizations are now required to continuously monitor and manage cyber risks that could materially impact their bottom line. Failure to meet these expectations can lead to significant fines, operational disruptions, and reputational damage.

SAFE leverages the FAIR model, the industry standard for quantifying cyber risk in monetary terms, alongside AI-driven, real-time reporting. This empowers enterprises to meet stringent compliance requirements, enhance board-level oversight, and ensure transparency on the material impact of cybersecurity risks.